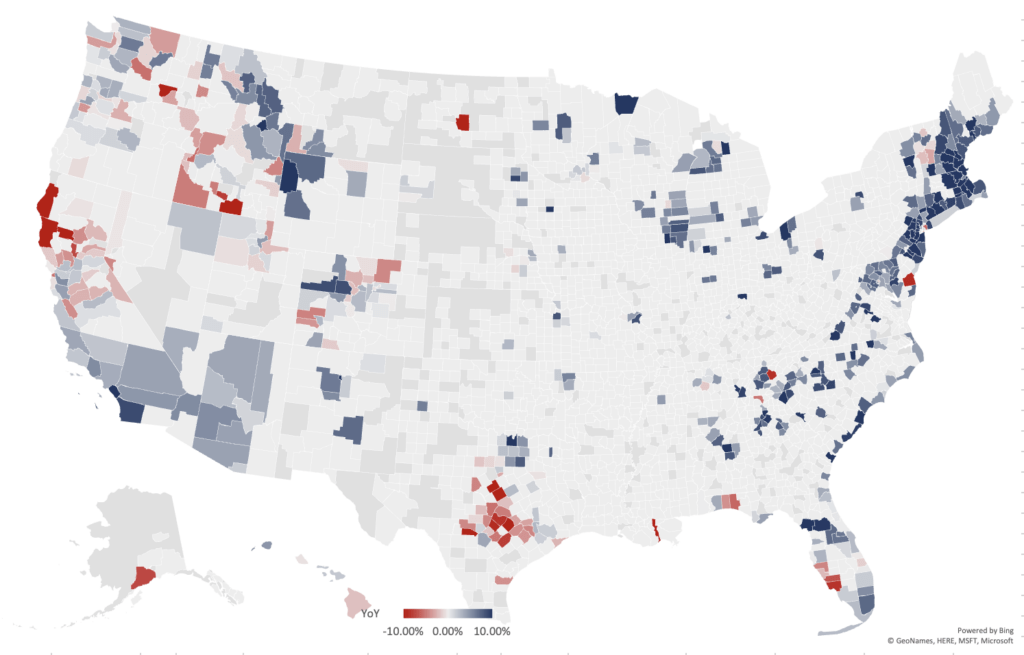

June 2024 Luxury Real Estate Report: Insights from the Updated Map of the U.S. Luxury Real Estate Market

Explore the latest trends in the U.S. luxury real estate market with our newest report. Discover key insights into regional market dynamics, significant shifts in property values, and the new areas entering the luxury and uber-luxury thresholds. Essential reading for investors and professionals navigating the complexities of high-end real estate.

U.S. Luxury Real Estate Market Analysis: June 2024

As we cross into mid-2024, the U.S. luxury real estate market showcases a spectrum of regional performances, from significant growth to noticeable declines. The latest market data reveals intriguing trends and notable insights for luxury real estate professionals. Here’s an in-depth look at the current state of the market, focusing on regional highlights, unusual insights, and emerging trends.

Regional Highlights

West Coast

California:

The luxury real estate market in California is experiencing notable shifts. Northern California, especially the San Francisco Bay Area, is marked by significant declines, with some counties showing YoY drops of up to -10%. High living costs and migration trends away from urban centers likely contribute to this downturn. Meanwhile, Southern California offers a mixed picture. Los Angeles County shows resilience with minimal changes, whereas Orange County faces slight declines. These patterns underscore the diverse dynamics within California’s luxury market.

Oregon and Washington:

Oregon’s luxury market is also under pressure, particularly around Portland, where economic shifts and demographic changes are influencing property values. Conversely, Washington State maintains stability. King County, home to Seattle, continues to exhibit steady growth, reflecting the area’s economic strength and appeal.

Northeast

Strong Growth:

The Northeast Corridor, extending from Washington D.C. through New York and into New England, stands out as a robust growth area. Counties in New York, New Jersey, and Massachusetts are highlighted in dark blue, indicating substantial YoY increases. This region’s economic resilience, cultural amenities, and educational institutions make it a prime location for luxury real estate investments. Properties in suburban areas like Westchester County (NY), Bergen County (NJ), and Middlesex County (MA) are particularly in demand, appealing to buyers seeking space and high-quality living standards.

Southeast

Florida:

Florida presents a mixed market landscape. While counties such as Miami-Dade and Palm Beach show growth, other areas are lagging. The varied performance reflects local economic conditions and climate-related concerns. Miami-Dade continues to attract international buyers and retirees, bolstering its luxury market.

Georgia:

Georgia’s luxury market also displays mixed results. Metro Atlanta is a highlight, with growth driven by its robust economy and cultural offerings. In contrast, rural counties are facing declines, highlighting the uneven nature of the market. The urban-rural divide in Georgia underscores the importance of location-specific strategies in real estate investments.

Mountain States

Emerging Markets:

The Mountain States, including Colorado, Utah, and Idaho, are emerging as new hotspots for luxury real estate. Counties such as Pitkin (Aspen, CO), Summit (Park City, UT), and Blaine (Sun Valley, ID) show significant positive growth. The appeal of these regions lies in their scenic beauty, outdoor recreational opportunities, and lower population densities compared to urban centers. Luxury buyers are increasingly drawn to the lifestyle and space these areas offer.

Unusual and Interesting Insights

Texas:

A striking insight from the updated research is the significant declines in major Texas metros, particularly around Houston. This is unexpected given Texas’s strong real estate reputation. Factors such as oil market volatility and high property taxes might be contributing to this downturn. Despite the overall state’s economic strength, these specific areas highlight the complexities within regional markets.

Alaska:

Another notable area is Alaska, where Anchorage shows a marked decline. The unique economic challenges, including reliance on oil and fluctuating tourism, are likely driving these trends. This decline in Anchorage contrasts with its past stability, pointing to broader economic shifts impacting the luxury market.

Hawaii:

Hawaii presents a mixed trend. Honolulu sees growth, while other regions face declines. The state’s heavy reliance on tourism and recent natural disasters could explain these mixed results. Luxury real estate professionals in Hawaii need to navigate these challenges carefully, balancing the demand from international buyers with local economic conditions.

Midwest Stability:

The Midwest remains a model of consistency, with fewer extreme changes in either direction. This stability makes it a reliable market for conservative investors seeking steady returns. The Midwest’s performance underscores the value of diversification in a real estate portfolio, providing a counterbalance to more volatile regions.

Remote Work Influence

The rise of remote work continues to reshape the luxury real estate market. Demand is growing in suburban and rural areas offering spacious properties and high-quality living environments. Counties in Colorado, Utah, and Idaho exemplify this trend, attracting buyers looking for lifestyle changes away from crowded urban centers. Luxury properties with amenities suited for remote work, such as home offices and expansive outdoor spaces, are particularly appealing.

The U.S. luxury real estate market in June 2024 is characterized by significant regional variations, driven by economic, demographic, and environmental factors. Understanding these dynamics is crucial for luxury real estate professionals aiming to navigate this complex market effectively.

From the robust growth in the Northeast Corridor to the emerging markets in the Mountain States, opportunities abound for those who stay informed and strategic. The varied performances across regions, such as the declines in California and Texas versus the stability of the Midwest, highlight the importance of tailored approaches and regional knowledge.

As the market evolves, staying attuned to emerging trends like the influence of remote work can provide a competitive edge. By leveraging these insights, luxury real estate professionals can better serve their clients and capitalize on the dynamic opportunities within the U.S. luxury real estate market.

Looking for our latest 12 month forecast down to the zip code? Follow this link

Year over Year National Luxury Real Estate Report Map:

Here are the recent Luxury Real Estate Report numbers for the data hounds:

Luxe Report Data July 2024

Methodology for RE Luxe Leaders Luxury Real Estate Report

The data used in the report is focused on the top one-third of markets in the United States, and is collected on a monthly basis. The data is used to identify trends in luxury real estate at the area level, rather than focusing on individual properties. The report aims to provide insight into luxury real estate trends across the country, by analyzing data from the most affluent and desirable markets in the United States.

We divide and define the US National Luxe Real Estate into three categories for our Luxury Real Estate Report:

- Executive Class. Areas where properties currently average sold prices of $750,000 and higher.

- Luxe. Areas where properties currently average sold prices of two million dollars and higher.

- Ultra-Luxe. Areas where properties currently average sold prices of five million dollars and higher.

Luxury Real Estate Report: Parting Thoughts

Embark on a Journey of Excellence in Luxury Real Estate

You’ve scratched the surface and glimpsed the transformative insights of luxury real estate. Now, we invite you to delve deeper. Our Luxury Certification Course is your gateway to becoming a connoisseur of high-end properties, an expert in refined client experiences, and a true leader in the market.

Why Join?

- Master the art of luxury transactions.

- Gain exclusive industry knowledge and cutting-edge strategies.

- Network with elite professionals and elevate your influence.

What Awaits You?

- Comprehensive training by seasoned experts.

- Practical tools for immediate application.

- A distinguished certification that sets you apart.

Ready to transcend the ordinary? Click Here to start your journey toward becoming a certified authority in luxury real estate.

For additional and real time insights, updates and news from our Founding and Managing Partner, Chris Pollinger, you can follow him on LinkedIn – Twitter – Facebook – Instagram