Luxury Real Estate Report: August 2023 – Wealth Dynamics in America

Here is the current 2023 Luxury Real Estate Report by the staff at RE Luxe Leaders. At RE Luxe Leaders, we’re passionate about digging into the data to spotlight trends that empower you to make savvy business choices.

Over the past year, a staggering $92 billion in wealth migrated out of New York and California, as affluent individuals chose to relocate to states with favorable tax structures. While the pandemic played a role, this wealth transfer was not solely its aftermath. Beneficiaries of this migration include states like Florida and Texas, notably due to their absence of income tax. In a striking example, Florida’s income surged by $39 billion in 2021, marking a robust 39% increase from its previous year.

Luxury Real Estate Report: Insights into Leading Luxury Regions

We delve into the performance metrics and patterns of premier luxury locales from August 2022 to July 2023.

- Jupiter Island, FL:

- This region upheld its reputation as the priciest, consistently throughout the year.

- A downturn was observed from August 2022 until February 2023, post which the prices showed resilience, almost returning to their starting figures by July 2023.

- Hunts Point, WA:

- A marked price drop was seen from August to October 2022.

- Prices regained stability and a subtle rise till June 2023, only to decline slightly the following month.

- Atherton, CA:

- Throughout the year, a consistent decline was evident, interrupted by a modest resurgence in June 2023.

- Manalapan, FL:

- September 2022 saw the onset of a price surge which peaked between March and April 2023.

- Post-April, the market plateaued with a minor drop observed in July.

- Golden Beach, FL:

- The year showcased steady prices with minor ebbs and flows.

- An upward trend was distinct between April and June 2023.

Luxury Real Estate Report: Highlights of Housing Price Variations

Spotlighting cities that witnessed the most remarkable price inflations and deflations over the previous year.

Top Gainers:

- Manalapan, FL: Enhanced by an approximate $1,353,907.

- Wilson, WY: Ascended by around $767,322.

- Hanalei, HI: Boosted by nearly $699,050.

- Lake Buena Vista, FL: Improved by about $669,577.

- Sea Island, GA: Rose by nearly $315,476.

Top Decliners:

- Glenbrook, NV: Diminished by around $1,183,999.

- Hunts Point, WA: Slumped by nearly $1,068,112.

- Malibu, CA: Receded by about $890,293.

- Stinson Beach, CA: Declined by roughly $854,874.

- Atherton, CA: Fell by approximately $772,766.

Luxury Real Estate Report: An Overview of States Dominating the Luxury Segment

Now, a analysis detailing states with a substantial luxury market presence and the median price transitions they experienced.

- California (CA):

- Dominates with an impressive 332 luxury locales.

- A median price reduction by an estimated $167,314 was noted over the year.

- New York (NY):

- Flaunts 117 upscale areas.

- Surprisingly, a modest median price augmentation of about $6,711 was observed annually.

- New Jersey (NJ):

- Boasts of 107 elite zones.

- The median price descended by around $9,261.

- Massachusetts (MA):

- Proudly holds 95 posh locales.

- Yearly metrics reveal a median price dip of about $10,835.

- Florida (FL):

- Encompasses 93 lavish regions.

- Annual figures indicate a subtle median price decline of approximately $2,372.

- Washington (WA):

- With 66 plush areas, it’s a notable player.

- The annual drop in median price was a significant $84,935.

- Texas (TX):

- Claims 62 premier communities.

- A notable median price reduction of around $101,267 was recorded.

- Colorado (CO):

- Features 60 opulent neighborhoods.

- A median price dip of approximately $74,793 was noted over the year.

- Hawaii (HI):

- Presents 44 luxury enclaves.

- Yearly figures reveal a median price decline of about $44,131.

- Maryland (MD):

- Enjoys 39 premier locales.

- A slight median price drop of around $8,221 was observed.

Luxury Real Estate Report: A Few Insights on the International Luxury Market

Current research on the international luxury real estate market offers several key insights. The core definition of luxury has significantly changed over the past few years, and ultra-high-net-worth individuals are now a significant driving force in the luxury home buying market. These individuals, with their diversified investment portfolios, will continue to have significant influence in the market in the coming years.

The intrinsic value of purchasing real estate has never been higher, with wealthy buyers being motivated by lifestyle changes and opportunities in the current market environment. We anticipate a high volume of international buyers, a growing influence among younger millionaires, and a continued appetite for secondary homes.

Ownership of multiple homes, both in the U.S. and abroad, is becoming a trend among wealthy individuals. 72% of wealthy buyers said their future home purchase would be a second residence, vacation home, or rental property. Notably, Gen-X and millennials are leading the way in this trend. Furthermore, the propensity to own a home abroad is on the rise due to the strength of the U.S. dollar and rising costs of U.S. living. Europe, Central America, and Asia are among the increasingly popular locations for these buyers.

Additionally, the number of global millionaires is at its highest point in history and is expected to surge by 40% by 2026. Major U.S. markets and traditional centers of wealth, continue to be a significant draw for affluent international buyers. Cities in Asia, such as Singapore, Beijing, and Guangzhou, have regained their position in the top global cities with primary and secondary homeowners as borders have reopened.

When it comes to the factors influencing the choices of luxury real estate buyers, property location, home condition, and amenities rank as the highest priorities. Open floor plans, bespoke architectural elements, neutral color palettes, and tech-friendly homes with automation systems, energy-efficient appliances, and electric vehicle charging stations are among the top trends.

Luxury Real Estate Report: Navigating the Luxury Real Estate Landscape

In the luxury real estate market, it’s all about identifying opportunities and staying one step ahead. By closely monitoring trends and leveraging the insights we’ve shared here, you’re positioning yourself for growth and success in this thrilling industry. Remember, in real estate, as in life, the key to success lies in understanding the terrain and charting your path with confidence and foresight.

Luxury Real Estate Report: Diving Deeper

Recently, we conducted a keynote presentation where we delved deeper into these trends. If you’re interested in gaining valuable insights from our research and analysis, you can access it here.

Looking for our latest 12 month forecast down to the zip code? Follow this link

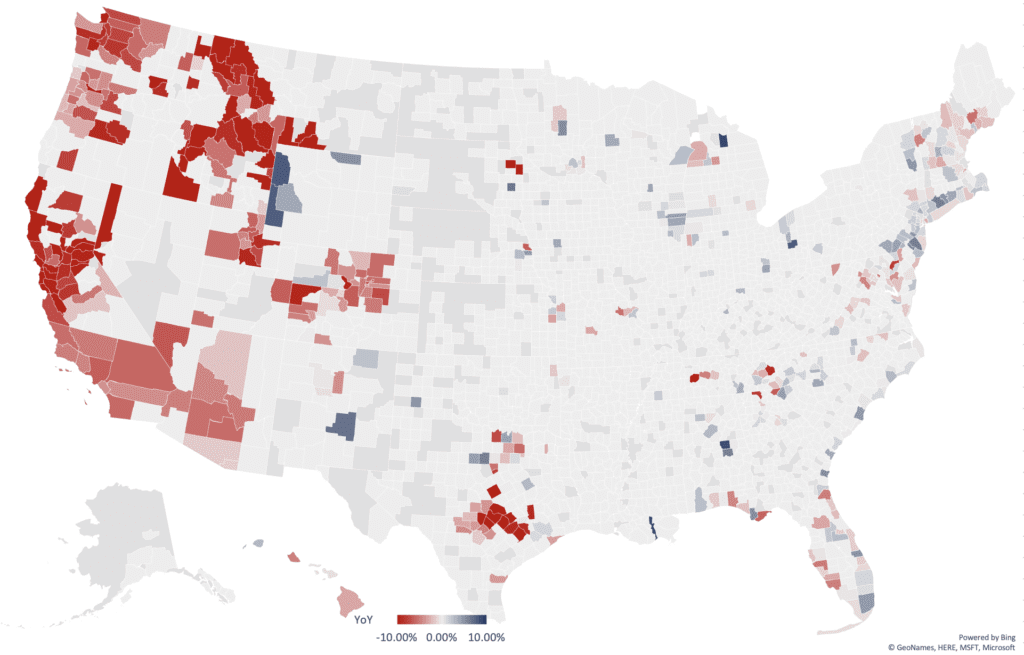

Year over Year National Luxury Real Estate Report Map:

Here are the August 2023 Luxury Real Estate Report numbers for the data geeks:

Luxury-Real-Estate-Report-Data-August-2023

Methodology for RE Luxe Leaders Luxury Real Estate Report

The data used in the report is focused on the top one-third of markets in the United States, and is collected on a monthly basis. The data is used to identify trends in luxury real estate at the area level, rather than focusing on individual properties. The report aims to provide insight into luxury real estate trends across the country, by analyzing data from the most affluent and desirable markets in the United States.

We divide and define the US National Luxe Real Estate into three categories for our Luxury Real Estate Report:

- Executive Class. Areas where properties currently average sold prices of $750,000 and higher.

- Luxe. Areas where properties currently average sold prices of two million dollars and higher.

- Ultra-Luxe. Areas where properties currently average sold prices of five million dollars and higher.

Luxury Real Estate Report: Parting Thoughts

We hope that the information provided is helpful in guiding you on your journey to building a thriving real estate business.

As luxury real estate consultants, coaches and advisors for Proptech, Fintech, Brands, Brokerages, Teams and Elite agents, we are confident that our resources, insights and strategies can help you achieve your goals.

Remember, success in the luxury real estate industry starts with knowledge and strategy, and we are here to provide you with both.

Here are some links to our more popular resources:

- Real Estate Insights from our luxury real estate consultants to help you out position your competitors

- Downloads and Tools To Accelerate the Growth of Your Real Estate Business from our amazing luxury real estate coaches

- Exclusive Luxe Real Estate Reports and Forecasts to give you an edge

- Luxury Real Estate AI Tools we have specifically trained to make your life easier

If you’re wondering what consulting or coaching solutions we offer, we’ve set up a handy wizard to guide you to the ideal options that would be tailored to your situation.

For additional and real time insights, updates and news from our Founding and Managing Partner, Chris Pollinger, you can follow him on LinkedIn – Twitter – Facebook – Instagram