March 2025 National Real Estate Forecast: Insights and Trends for 2025

Explore our National Real Estate Forecast for 2025 for comprehensive insights into the U.S. luxury real estate market. Stay ahead with our expert analysis on economic trends, legislative changes, and regional dynamics, crucial for informed decision-making and strategic planning in the luxury real estate sector.

Updated Market Outlook for 2025

With a pro-business administration fostering economic optimism, the luxury real estate market is poised for growth. However, regional price shifts reveal a more nuanced landscape, as some high-tax urban areas experience stagnation while emerging secondary markets surge ahead.

Luxury buyers continue to prioritize exclusivity, climate resilience, and lifestyle-driven investments, signaling a shift from trophy properties to “stealth wealth” residences in lower-profile but high-value regions.

Key Factors Impacting the Luxury Market

1. Elevated Business Confidence, but Uneven Market Performance

Business optimism remains strong among HNWIs, yet market performance varies widely:

• Urban Slowdown: High-tax areas like San Francisco (-1.31%), Marin County (-2.13%), and Santa Clara County (-1.76%) continue to struggle despite potential tax relief.

• Suburban & Rural Booms: Key counties are seeing strong price growth, led by:

• Montana (Cascade County +4.35%)

• North Carolina (Transylvania County +4.56%)

• Colorado (Pitkin County +4.38%)

• Idaho (Teton County +4.43%)

Emerging Luxury Hotspots

• Litchfield County, CT (+4.46%) is becoming a suburban alternative to New York.

• Washington County, VT (+4.29%) benefits from the Northeast’s luxury migration.

• Lincoln County, MT (+4.40%) continues to attract affluent buyers seeking privacy and scenic escapes.

2. “Stealth Wealth” Grows in Influence

Privacy-focused luxury purchases are reshaping key markets:

• Exclusive off-market transactions are up in areas like Aspen (CO), Jackson Hole (WY), and Palm Beach (FL).

• Discreet properties in emerging luxury markets are gaining traction, such as Graves County, KY (+4.40%) and Marion County, KY (+5.10%).

Opportunities for Agents:

• Develop private client networks for UHNWIs seeking exclusive transactions.

• Position low-key luxury estates as sophisticated alternatives to high-profile properties.

3. Easing Regulations Boost Development in Rural Areas

Developers are taking advantage of relaxed regulations in states where demand for high-end homes is rising:

• Luxury buyers seek privacy and space in nature:

• Newton County, AR (+2.35%) and San Miguel County, CO (+2.30%) are attracting buyers looking for self-sufficient estates.

• Florida’s Hardee County (+3.75%) and Hendry County (+5.55%) are seeing strong demand in the ultra-luxury sector.

4. Tax Policy Shifts Shape Buyer Behavior

Potential SALT cap adjustments are not reversing declines in high-tax regions:

• Winners:

• Litchfield County, CT (+4.46%), showing suburban strength.

• Palm Beach County, FL (+1.92%), attracting tax-conscious buyers.

• Losers:

• San Francisco (-1.31%), Santa Clara (-1.76%), and New York (Manhattan price stagnation) struggle despite tax policy shifts.

5. Climate Migration Drives Demand for Resilient Markets

Buyers are prioritizing climate-safe, inland locations:

• Resilient inland areas thriving:

• Montana (Cascade County +4.35%), Colorado (Routt County +3.84%)

• Coastal markets face insurance hurdles:

• Louisiana luxury counties declining (-4% to -7%) due to risk concerns.

• Hawaii (Honolulu -0.77%) seeing slowed demand.

6. The Shift to Secondary & Tertiary Markets Accelerates

Luxury buyers are leaving traditional hubs for high-value, low-cost alternatives:

• Top-performing counties:

• Kentucky (Taylor County +4.80%)

• Missouri (Howell County +3.60%)

• North Carolina (Harnett County +3.01%)

7. Financing Trends Favor Growth in Rural Luxury Markets

If interest rates stabilize, suburban and rural luxury markets could see continued buyer interest:

• Idaho (Elmore County +2.73%) and Colorado (Garfield County +3.43%) remain strong.

• Florida (Hardee County +3.75%) remains a tax haven for HNWIs.

8. The “Experiential” Luxury Home Trend Gains Momentum

Buyers prioritize estate amenities over location prestige:

• Top Features in High Demand:

• Private wellness spas & resort-style pools

• Vineyards, equestrian estates, and curated concierge services

• AI-powered smart security systems

Regional Trends Worth Watching

1. High-Tax Havens Face Mixed Outcomes

• Litchfield County, CT (+4.46%) benefits from NYC exodus.

• California counties like Marin (-2.13%) and Santa Clara (-1.76%) struggle with affordability.

2. Mountain West & Southeast Boom

• Colorado (Pitkin County +4.38%) and Idaho (Teton County +4.43%) draw lifestyle buyers.

• Florida (Hendry County +5.55%) leads in price growth.

3. Rural Resilience & Emerging Markets

• Kentucky (Taylor County +4.80%) and Montana (Flathead County +4.26%) attract buyers looking for affordability and lifestyle benefits.

4. Urban Cooling Continues

• Major hubs like San Francisco (-1.31%) and NYC stagnate, requiring agents to reposition luxury properties as long-term wealth assets.

5. International Buyers Maintain Interest

• Miami (+2.00%) and Los Angeles remain key entry points for global buyers, but less saturated markets are gaining appeal.

What Luxury Agents Should Prioritize

✅ Leverage Tax Shifts: Target HNW clients in tax-heavy states, but address affordability concerns.

✅ Spotlight Emerging Hotspots: Focus on secondary luxury markets showing high growth.

✅ Reframe Urban Listings: Market urban properties as long-term wealth investments.

✅ Explore Rural Opportunities: Shift to luxury-friendly rural counties with strong demand.

✅ Market to International Buyers: Capitalize on Miami & Los Angeles, while exploring new global demand areas.

The Bigger Picture

Luxury real estate in 2025 is evolving beyond traditional trends, shaped by tax policies, climate concerns, and shifting lifestyle preferences. By embracing data-driven insights, expanding into secondary markets, and adapting to new buyer demands, brokers and agents can maximize opportunities in this dynamic luxury landscape.

In this landscape, RE Luxe Leaders stand out by offering bespoke coaching, consulting, and training services specifically designed for luxury real estate professionals. By focusing on personalized strategies, market insights, and innovative solutions, we empower you to not just survive but thrive, transforming challenges into opportunities for success.

Join us at RE Luxe Leaders and redefine excellence in luxury real estate. Let’s shape the future together, where every detail matters, and success is not just achieved but exceeded.

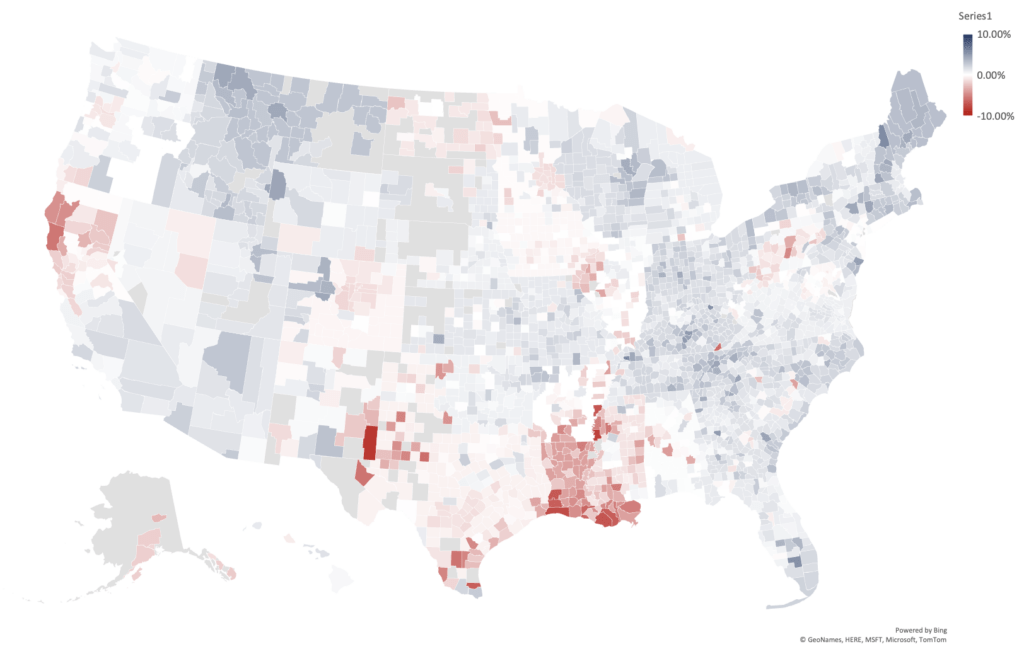

National Real Estate Forecast for 2025 Map:

If you are interested in a deeper dive in your area, let us know. We love talking about real estate, both generally as well as the individual pockets and the unique drivers behind each one.

Below we include the download of the National Real Estate Forecast for 2025 down to the County for the data hounds.

Luxe Forecast 2025-03

National Real Estate Forecast for 2025: A Parting Thought

Real Estate Luxury Leaders is where luxury agents, teams, and brokers turn their potential into unparalleled success. In the fast-paced world of luxury real estate, we provide the missing piece: bespoke coaching tailored to the unique demands of an exclusive market. We equip you with the strategies, insights, and support needed to not just navigate but dominate the luxury real estate landscape. With Real Estate Luxury Leaders, elevate your business, empower your team, and redefine excellence. Let’s build your legacy together.