Growth without structure doesn’t scale—it breaks. Many firms add headcount, leads, and tools, yet margins compress, client experience drifts, and leadership spends more time firefighting than forecasting. If production depends on a few rainmakers and you can’t trust the pipeline by week two, you don’t have an operating model—you have effort.

The solution is not another platform or incentive. It’s a brokerage operating system that institutionalizes how you decide, sell, deliver, and measure. Built well, it removes heroics, compresses cycle time, and makes performance repeatable across agents, teams, and markets. Below is the pragmatic build—serious strategy for serious operators.

1) Governance and Decision Rights

Top firms reduce noise by clarifying who decides, on what cadence, and by which criteria. Define a simple, written governance model: executive weekly (WBR), monthly P&L review, and quarterly strategy. Tie each decision type to a single accountable owner, with an escalation path that’s fast and final. Document role charters and a RACI for core workflows (lead routing, pricing guidance, listing launches, dispute resolution). Publish SOPs in a searchable knowledge base and enforce version control—one source of truth.

Action: Stand up a 1-page decision-rights matrix and a 6-week agenda for your WBR. If a topic lacks an owner or KPI, it doesn’t hit the agenda.

2) Revenue Architecture and Unit Economics

Revenue that scales is engineered, not hoped for. Portfolio your lead channels and track CAC, speed-to-lead, conversion by stage, and LTV by cohort. Build channel-level P&Ls and set pre-agreed “sunset” rules when CAC/LTV, cycle time, or adoption miss guardrails. Align splits and incentives with contribution margin, not lore. Standardize pipeline stages and definitions across CRM and finance—no bespoke stages per team. Commit to forecast accuracy targets by 30/60/90 days and report plan/forecast/actual weekly.

Action: Publish a channel scorecard (CAC, LTV, conversion, cycle time) and reset budgets quarterly. Remove any spend that can’t prove contribution margin within 90 days.

3) Client Experience Standards

Differentiation is operational, not decorative. Codify service standards as SLAs: speed-to-lead (in minutes), prep-to-list timeline (hours), offer readiness (same-day), updates cadence, and post-close follow-up. Build checklists for pre-listing package, listing launch, offer prep, and escrow milestones. Instrument the experience with NPS and CES at two moments: post-appointment and post-close. Calibrate standards by segment—luxury, move-up, investor—but keep one backbone of measurement. Consistency fuels referrals and reduces rework.

Action: Implement a 12-step listing launch checklist with owner, due date, and automated confirmations. Tie manager bonuses to SLA adherence and NPS trends, not just volume.

4) Talent System and Performance Management

High performers are built by design. Create role scorecards with 5–7 measurable outcomes, not vague traits. Map a 30/60/90-day ramp for every seat, including training, certifications, and production milestones. Establish a clean coaching cadence: weekly pipeline review, monthly skills clinic, quarterly business planning. Maintain manager spans of control (8–12 agents) to protect coaching quality. Define exit criteria upfront—missed leading indicators trigger a documented performance plan, not hope.

Action: Replace annual reviews with a monthly scorecard: activity quality, stage conversion, SLA adherence, and client satisfaction. Promotions follow evidence, not tenure.

5) Data, Dashboards, and Operating Rhythm

What you measure repeats; what you don’t, drifts. Instrument 12 core KPIs: new MQLs, speed-to-lead, appointment set rate, appointment kept rate, signed engagements, list-to-contract days, contract-to-close days, fall-through rate, gross commission, net margin, forecast accuracy, and cash conversion cycle. Enforce CRM as the source of truth: if it’s not in the CRM, it didn’t happen. Run a weekly business review with fixed inputs (scorecards, blockers, decisions) and time-boxed problem solving. Treat data integrity as a leadership behavior—missing data incurs consequence.

Action: Roll out a single dashboard for executives and managers. Hide vanity metrics. Color-code by variance to target and assign one owner per KPI.

6) Risk, Compliance, and Documentation

As volume grows, risk compounds. Standardize transaction checklists, document retention, and audit trails for pricing advice, disclosures, and agency. Centralize policy for fair housing, advertising, privacy, and recordkeeping; train to scenarios, not slides. Require E&O-prevention steps within the workflow (e.g., automated compliance stops before listing activation). Schedule quarterly file audits and publish findings. A strong risk posture can lower insurance costs and prevent expensive rework.

Action: Move compliance from “end-of-process” to in-line controls. Add mandatory fields and approvals in the CRM/TC workflow; no checklist, no next step.

7) Technology Stack and Automation

Tools don’t create scale; integrated workflows do. Define your system of record (CRM) and integrate scheduling, transaction management, e-signature, and accounting. Use automation for triage: lead routing by rules, SLA timers, checklist creation, and status updates. Stand up a secure knowledge base with versioned SOPs and searchable playbooks. Apply AI where it compounds productivity—drafting templated updates, summarizing file notes, or surfacing risk cues—not where judgment is non-negotiable. Set adoption thresholds: if a tool can’t reach 80% usage in 90 days, fix it or cut it. For broader context on where AI reliably adds leverage, see The economic potential of generative AI: The next productivity frontier by McKinsey & Company.

Action: Publish an integration map and a 12-month deprecation plan for redundant tools. Measure cost per seat and cost per transaction quarterly.

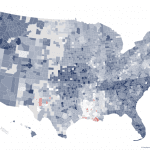

Market Context: Why Discipline Wins Now

Capital has become more selective, and underwriting is tighter. Operators who can prove consistent margins, cycle-time compression, and repeatable demand generation will outlast volatility. This is consistent with the operational focus highlighted in Emerging Trends in Real Estate 2024 from PwC and the Urban Land Institute—where discipline, data, and cost control separated resilient firms from fragile ones.

Put It Together: The Brokerage Operating System

When these components work together, you have a true brokerage operating system: one language for performance, one cadence for decisions, one experience for clients, and one data spine for truth. The outcome is institutional: higher forecast accuracy, faster cycle times, tighter margins, lower risk, and a firm that’s transferable—not just a personal production engine.

Practical next steps:

- Start with governance and the WBR. Without a decision cadence, everything else stalls.

- Harden the data backbone. Lock pipeline definitions; enforce CRM-as-truth.

- Codify SLAs and publish checklists. Train to them, measure them, reward adherence.

- Rebuild comp against unit economics. Pay for contribution margin, not volume alone.

- Rationalize the stack. Integrate, automate, and prune. Adoption or removal—nothing in between.

At RE Luxe Leaders® (RELL™), we help elite operators implement these disciplines to institutional standards. If your current model relies on heroics or vendor promises, you’re exposed. The fix is structural, not motivational.

Conclusion

Legacy is built on systems. A scaled brokerage is not a bigger version of what you have—it’s a tighter one. Codify governance, revenue architecture, client standards, talent, data, risk, and technology into a brokerage operating system, and you convert volatility into durable enterprise value. This is the work of owners, not just producers—and it’s the difference between a strong year and a strong company.

Explore how RE Luxe Leaders® implements the RELL™ framework inside top-performing firms, or move directly to a private consult.