5 Strategic Tips to Save Money for Real Estate Brokers

Real estate brokerage leadership carries a persistent tension: sustaining profitability while managing rising expenses. The pressure to optimize the bottom line grows sharper as markets fluctuate and operational complexity increases. For seasoned brokerage owners and high-level leaders, strategic cost management is not about cutting corners—it’s about prudent investment and efficiency.

Carefully aligning expenses with business goals can unlock resources for sustainable growth and succession planning. Below are five targeted ways to reduce costs without compromising service quality or operational effectiveness.

Use Technology to Your Advantage

Modern brokerage operations demand operational maturity supported by purposeful technology adoption. Investing in high-quality software—such as advanced customer relationship management (CRM) systems or transaction management platforms—can automate repetitive tasks, minimize administrative errors, and accelerate deal closings.

Automation not only reduces labor costs but also improves data accuracy and compliance oversight, mitigating costly errors. For example, platforms like Real Estate CRM Solutions offer tailored workflows that align with brokerage processes, enabling data-driven decisions and efficiency gains.

Leaders at the top tier increasingly view technology as a force multiplier to scale without proportionally increasing headcount.

Be Strategic About Marketing

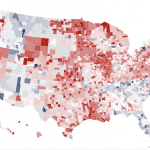

Marketing spend demands surgical precision. Instead of a scattergun approach, top brokerage leaders analyze demographic data and customer journey behaviors to allocate budget where return on investment is highest.

For instance, if your core clientele skews toward millennial homebuyers, prioritizing digital channels like social media and targeted SEO campaigns provides superior lead conversion compared to generic print outreach. Conversely, targeting established affluent buyers may warrant investment in personalized networking events or high-end direct mail.

Research shows that data-driven marketing strategies can improve lead quality and reduce wasteful expenditure. Regularly reviewing marketing analytics and adapting accordingly ensures your funnel remains optimized.

Collaborate with Other Brokers

Strategic partnerships among boutique brokerages can unlock cost savings and valuable knowledge exchange. Sharing office space, marketing expenses, or administrative resources can yield measurable overhead reductions, critical in high-rent markets.

Collaboration extends beyond finances: co-marketing opportunities, joint training sessions, and pooled market intelligence sharpen competitive advantage. This peer alliance model is a hallmark of mature brokerage operations seeking scalable, risk-mitigated growth.

Approach collaboration with clearly defined agreements and aligned goals to maximize mutual benefit without compromising brand integrity.

Negotiate with Vendors and Suppliers

Brokers often overlook the financial impact of vendor contracts and supplier terms. With deliberate market research and negotiation, it’s possible to secure favorable pricing and flexible terms—ranging from office supplies to marketing vendors.

Effective negotiation requires preparation: benchmarking standard industry rates and understanding vendor cost drivers. Be transparent about your business needs yet flexible to create win-win agreements. Don’t hesitate to request volume discounts or bundled service packages.

Seasoned leaders cultivate long-term vendor relationships leveraging volume and reliability to negotiate continuously improved terms over time.

Keep Your Overhead Costs Low

For most brokerages, overhead consumes a significant portion of revenue—office rent, utilities, administrative salaries, and more. Top leaders challenge traditional fixed cost models by adopting hybrid or fully remote setups and engaging virtual assistants or outsourced specialists for non-core tasks.

Moving to shared workspaces or high-functioning remote arrangements not only reduces rental and utility expenses but also expands talent accessibility and operational agility.

Outsourcing administrative roles permits staffing flexibility—scaling support up or down in response to transaction volume—without incurring full-time salary commitments. This strategic expense management preserves capital for growth initiatives or succession readiness.