March 2024 Luxury Real Estate Report

Explore the latest trends in the U.S. luxury real estate market with our newest report. Discover key insights into regional market dynamics, significant shifts in property values, and the new areas entering the luxury and uber-luxury thresholds. Essential reading for investors and professionals navigating the complexities of high-end real estate.

Updated Luxury Real Estate Market Analysis – March 2025

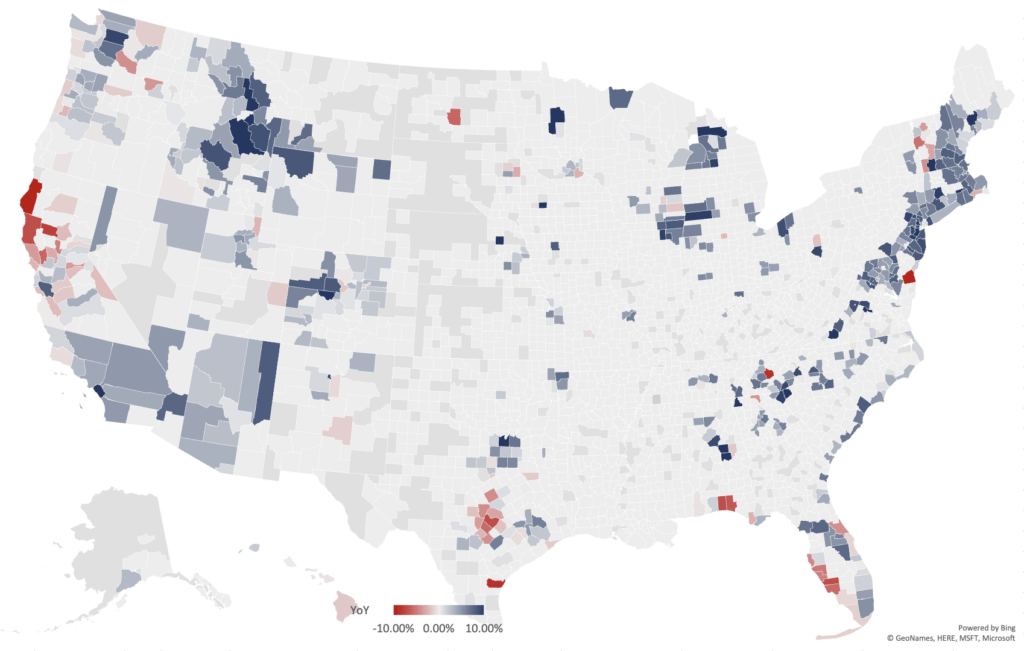

The luxury real estate market in 2025 continues to shift due to economic conditions, changing buyer preferences, and regional divergence. The latest Luxe Report (March 2025) highlights growing strength in suburban and rural luxury markets, continued weakness in high-tax urban centers, and increasing selectivity among affluent buyers.

While pro-business policies and a strong stock market have fueled HNW investor confidence, rising interest rates, tax policy uncertainty, and climate concerns are driving a more cautious and strategic approach to luxury real estate purchases.

Key Market Trends & Insights (March 2025 Luxe Report Update)

1. Urban Slowdown vs. Suburban & Rural Strength

• California’s ultra-luxury markets are softening:

• Beverly Hills (-7.53%) and Atherton (-2.95%) continue to slide.

• San Francisco (-1.12%) and Marin County (-2.13%) see further declines due to high taxes and shifting buyer priorities.

East Coast luxury markets diverge:

• New York City stagnates, but New Jersey suburbs boom (Colts Neck Township, NJ +8.48%).

• Amagansett, NY (-10.09%) and Bronxville, NY (-10.54%) suffer price contractions.

Suburban & rural luxury markets continue to surge:

• Litchfield County, CT (+4.46%) and Bedford, NH (+7.36%) attract affluent buyers.

• Montana (Cameron, MT +19.22%) and Colorado (Carbondale, CO +10.78%) remain strong.

2. “Stealth Wealth” Drives Discreet Luxury Sales

HNWIs are shifting toward off-market and low-profile luxury properties:

• Aspen, CO (+7.70%) and Big Sky, MT (+11.40%) remain in high demand.

• Wealthy buyers prefer privacy-focused luxury in New Hampshire, Montana, and Vermont.

Agent Opportunities:

✅ Build exclusive networks for UHNW off-market transactions.

✅ Market discreet luxury estates as smart wealth preservation investments.

3. Interest Rates & Tax Uncertainty Shape Buyer Behavior

Despite optimism in financial markets, higher borrowing costs are impacting:

Luxury enclaves in California, Texas, and Florida see mixed performance:

• Calistoga, CA (-5.36%) and Bee Cave, TX (-6.45%) under pressure.

• Austin, TX (-6.70%) remains weak due to affordability concerns.

However, tax-friendly states still benefit:

• Palm Beach County, FL (+1.92%) and Belleair, FL (+4.45%) attract tax-conscious buyers.

4. Climate Migration Accelerates Luxury Market Shifts

Florida’s coastal markets face rising insurance costs:

• Boca Grande, FL (-8.54%) and Bradenton Beach, FL (-10.97%) show sharp YoY declines.

Buyers are opting for less risk-prone inland luxury retreats.

Western states with climate resilience see steady growth:

• Montana (Flathead County +4.26%), Colorado (Aspen +7.70%), and Vermont (Barnard -4.38%) remain attractive.

5. Emerging Luxury Hotspots in Secondary Markets

Luxury buyers are diversifying away from traditional markets:

Growing suburban and semi-rural demand:

• Bristol, RI (+8.12%) and Brielle, NJ (+11.73%) show consistent appreciation.

• Cashiers, NC (+8.44%) is emerging as a top luxury market in the Southeast.

Mountain West & Resort Towns remain resilient:

• Cameron, MT (+19.22%), Edwards, CO (+8.40%), and Bigfork, MT (+4.30%) lead investment growth.

6. Experiential Luxury Homes Gain Traction

Affluent buyers are prioritizing lifestyle-driven estates over traditional trophy homes:

Demand is rising for:

✅ Vineyards, equestrian estates, and wellness-focused properties.

✅ High-tech smart homes and AI-powered security.

Regional Market Trends (March 2025 Update)

📉 High-Tax Urban Luxury Enclaves Continue to Struggle

• New York & California markets face further headwinds:

• Manhattan luxury stagnation amid affordability and tax concerns.

• Belvedere, CA (-3.67%) and Berkeley, CA (-2.17%) continue to decline.

• Limited demand in ultra-luxury California communities:

• Beverly Hills (-7.53%) and Palo Alto (-2.95%) reflect tech sector volatility.

📈 Mountain West & Southeast Growth Continues

• Colorado & Montana remain prime investment zones:

• Cameron, MT (+19.22%) and Big Sky, MT (+11.40%) lead national luxury growth.

• North Carolina & Tennessee markets thrive:

• Cashiers, NC (+8.44%) and College Grove, TN (+2.99%) are benefiting from buyer migration.

📉 Florida’s Luxury Market Sees Growing Divergence

Resilient markets:

• Palm Beach County (+1.92%), Belleair, FL (+4.45%), and Biscayne Park, FL (+4.46%) attract tax-conscious buyers.

Declining markets:

• Boca Grande, FL (-8.54%) and Bradenton Beach, FL (-10.97%) struggle due to overvaluation and climate concerns.

Strategic Takeaways for Luxury Real Estate Professionals

✅ Target Tax-Conscious Buyers: Shift focus to tax-friendly states and suburban alternatives.

✅ Leverage “Stealth Wealth” Trends: Offer off-market deals and exclusive, private transactions.

✅ Promote Climate-Resilient Investments: Shift attention to inland and mountain markets as buyers seek safety.

✅ Monitor Market Volatility in High-Tax Urban Centers: New York and California need rebranding strategies for luxury properties.

✅ Capitalize on Experiential Luxury: Wellness, vineyard, and AI-driven luxury homes are outperforming traditional trophy properties.

Final Outlook: Luxury Market in 2025 Is Hyper-Localized

• Traditional luxury hubs (NYC, SF, LA) remain sluggish, requiring strategic repositioning.

• Affluent buyers are opting for privacy, climate resilience, and lifestyle properties.

• Secondary markets are booming, while overvalued resort towns are seeing pullbacks.

Agents who understand these shifting trends will be best positioned to thrive in the evolving luxury landscape.

Looking for our latest 12 month forecast down to the zip code? Follow this link

Year over Year National Luxury Real Estate Report Map:

Here are the recent Luxury Real Estate Report numbers for the data hounds:

Here are the recent Luxury Real Estate Report numbers for the data hounds:

Luxe Report 2025-03

Methodology for RE Luxe Leaders Luxury Real Estate Report

The data used in the report is focused on the top one-third of markets in the United States, and is collected on a monthly basis. The data is used to identify trends in luxury real estate at the area level, rather than focusing on individual properties. The report aims to provide insight into luxury real estate trends across the country, by analyzing data from the most affluent and desirable markets in the United States.

We divide and define the US National Luxe Real Estate into three categories for our Luxury Real Estate Report:

- Executive Class. Areas where properties currently average sold prices of $750,000 and higher.

- Luxe. Areas where properties currently average sold prices of two million dollars and higher.

- Ultra-Luxe. Areas where properties currently average sold prices of five million dollars and higher.

Luxury Real Estate Report: Parting Thoughts

Embark on a Journey of Excellence in Luxury Real Estate

You’ve scratched the surface and glimpsed the transformative insights of luxury real estate. Now, we invite you to delve deeper. Our Luxury Certification Course is your gateway to becoming a connoisseur of high-end properties, an expert in refined client experiences, and a true leader in the market.

Why Join?

- Master the art of luxury transactions.

- Gain exclusive industry knowledge and cutting-edge strategies.

- Network with elite professionals and elevate your influence.

What Awaits You?

- Comprehensive training by seasoned experts.

- Practical tools for immediate application.

- A distinguished certification that sets you apart.

Ready to transcend the ordinary? Click Here to start your journey toward becoming a certified authority in luxury real estate.

For additional and real time insights, updates and news from our Founding and Managing Partner, Chris Pollinger, you can follow him on LinkedIn – Twitter – Facebook – Instagram