The Rise of New Wealth Hubs: Wealth Migration in 2024

Explore the shifting global landscape as high-net-worth individuals migrate, creating new wealth hubs. Discover how sustainability, lifestyle, and evolving preferences are reshaping luxury real estate markets worldwide.

Key Drivers of Wealth Migration in 2024

The global distribution of wealth is experiencing a notable shift as high-net-worth individuals (HNWIs) increasingly relocate away from traditional financial epicenters like New York and London. This redistribution is propelled by a combination of personal, economic, political, and environmental factors.

Prominent among these are:

- Taxation Policies: Increasing tax burdens in historic hubs such as London drive affluent individuals to seek more favorable regimes. For instance, London’s elevated inheritance and income taxes have incentivized migration to lower-tax jurisdictions.

- Safety and Quality of Life: Concerns over public safety and lifestyle standards have prompted luxury buyers to favor cities like Miami, which offers a favorable climate combined with robust security and high-end amenities.

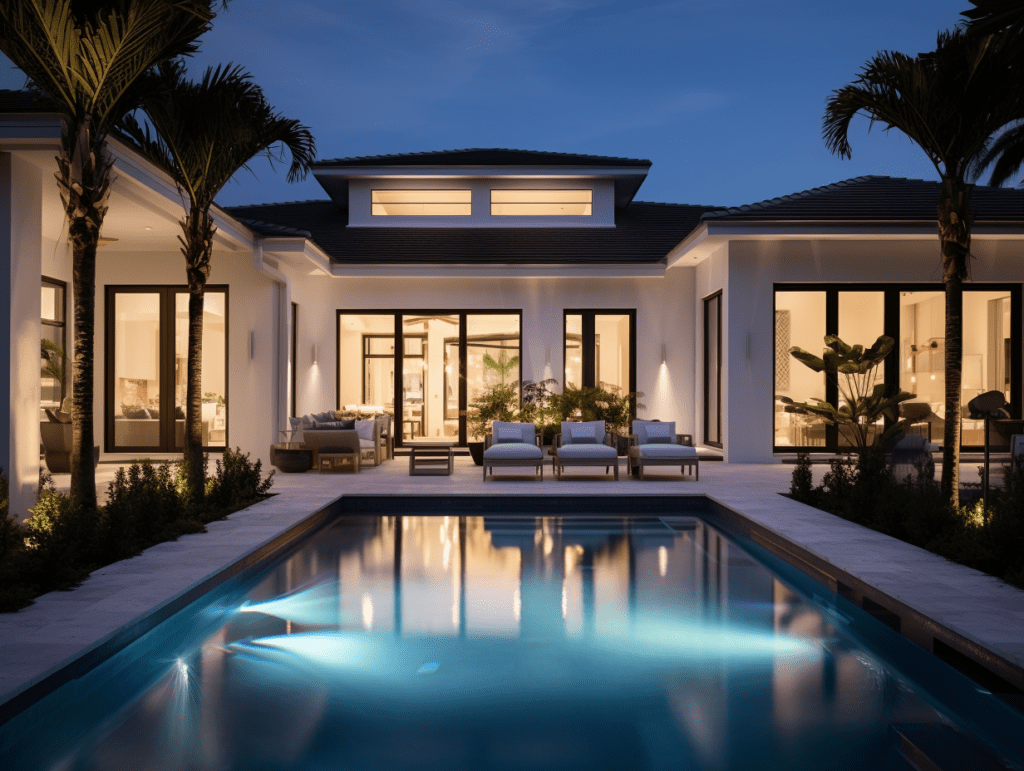

- Sustainability and Wellness Priorities: Modern wealth holders actively pursue locations and properties prioritizing green technology, privacy, and wellness facilities, aligning their living environment with personal values.

- Geopolitical Stability and Financial Infrastructure: Cities like Singapore attract emerging wealth from Southeast Asia due to stable governance and sophisticated wealth management platforms, with Singapore projected to be a top three wealth management hub by 2027, according to The Wealth Report 2024.

Competing cities employ incentives such as family office benefits and visa investment programs to establish or elevate their status as global wealth hubs — a trend reshaping the luxury residential market landscape.

Impact of Wealth Migration on Luxury Real Estate Markets

The movement of HNWIs to emerging wealth centers has tangible effects on luxury real estate pricing, inventory, and buyer preferences. While traditional markets retain global prominence, emerging hubs are recording notable surges in luxury property demand and pricing.

Key market changes include:

- Price Appreciation in New Wealth Hubs: Cities such as Miami, Milan, and Singapore are exhibiting annual luxury property price growth outpacing broader markets, fueled by demand and constrained supply.

- Shift Toward Sustainable and Wellness-Oriented Properties: Luxury buyers increasingly prioritize homes integrated with green building materials, renewable energy systems, and holistic wellness amenities including private gyms, spas, and gardens.

- Demand for Privacy and Sanctuary: Reflecting global unrest and lifestyle shifts, luxury property seekers are emphasizing privacy, secure access, and retreat-like environments.

These dynamics necessitate a reassessment of asset valuations and investment strategies in luxury real estate portfolios, with an emphasis on sustainability and holistic lifestyle value propositions.

Strategic Tactics for Luxury Brokers to Capitalize on Wealth Migration

For high-level brokers and brokerage owners, recognizing and adapting to these shifts offers a pathway to sustained growth and competitive differentiation. Tactical strategies include:

- Market Expansion Through New Wealth Hubs: Establish satellite offices or partnerships in emerging hubs with documented HNWI inflows to secure first-mover advantages.

- Tailored Client Experiences: Align service models with client values emphasizing privacy, wellness, and sustainability to deepen loyalty with discerning buyers.

- Data-Driven Market Intelligence: Leverage robust market data and analytics to identify hyper-local trends impacting pricing and demand, optimizing listing strategies.

- Customized Property Portfolio Development: Advise clients on acquiring properties meeting emerging criteria, including eco-certifications and wellness amenities.

- Risk Mitigation Advisory: Prepare clients for volatility inherent in nascent markets, including regulatory shifts and infrastructure development timelines.

Successful brokerage leadership in this environment requires agility, deep market insight, and an unwavering focus on client priorities.

Technology’s Role in Facilitating Luxury Real Estate Amid Wealth Migration

Digital tools and technological innovation underpin efficient luxury real estate transactions within and across new wealth hubs. Technologies shaping the field include:

- Virtual and Augmented Reality Tours: Enabling international buyers to evaluate properties remotely with high fidelity, overcoming geographical barriers.

- Blockchain and Smart Contracts: Enhancing transactional transparency, reducing friction, and accelerating closings in cross-border deals.

- Advanced Customer Relationship Management (CRM) Systems: Supporting personalized client engagement, data capture, and predictive analytics critical for managing high-touch sales cycles.

- AI-Driven Market Analysis: Providing brokers with real-time insights on pricing trends and buyer behavior to inform negotiation strategies.

Integration of these technologies is no longer optional but essential for brokerages seeking to serve a mobile, globalized clientele effectively.

Recruitment and Team-Building Strategies Amid Emerging Wealth Markets

Wealth migration also ushers new opportunities and challenges for brokerage leadership in talent acquisition and organizational growth.

Consider the following approaches:

- Targeting Local Expertise: Hire agents and staff with cultural familiarity and local market knowledge in new wealth hubs to enhance credibility and client connections.

- Cross-Market Talent Mobility: Enable existing high-performers to gain exposure and experience in emerging hubs to accelerate market penetration and knowledge transfer.

- Specialized Training in Sustainability and Wellness in Real Estate: Equip teams with skills to articulate and advise on these increasingly vital buyer demands.

- Leadership Development: Build succession pipelines mindful of the strategic directions shaped by wealth migration and market evolution.

Such talent strategies fortify brokerages’ adaptability and long-term resilience in a transforming marketplace.

Risks and Challenges in Emerging Wealth Hubs for Brokerages and Investors

While promising, new wealth hubs carry inherent risks and complexities that brokerages and investors must strategically manage:

- Regulatory Uncertainty: Emerging markets may face evolving legal frameworks, complicating compliance and transaction certainty.

- Market Volatility and Liquidity Concerns: Price spikes can be followed by corrections; thin market depth can impact exit strategies.

- Infrastructure and Service Gaps: Rapid growth can strain local amenities, impacting property desirability and client satisfaction.

- Competition and Market Saturation Risks: Accelerated entry of multiple players requires differentiation, operational excellence, and sustained client relationships.

Prudent due diligence, robust risk assessment, and strategic flexibility are essential for navigating these challenges while capitalizing on emerging opportunities.

For broader perspectives on global wealth shifts and their implications, consult McKinsey & Company’s insights on wealth management transformation.