May 2024 Luxury Real Estate Report: Navigating U.S. Luxury Real Estate Market Trends

Navigating U.S. Luxury Real Estate Market Trends

Explore the latest trends in the U.S. luxury real estate market with our newest report. Discover key insights into regional market dynamics, significant shifts in property values, and the new areas entering the luxury and uber-luxury thresholds. Essential reading for investors and professionals navigating the complexities of high-end real estate.

Explore the latest trends in the U.S. luxury real estate market with our newest report. Discover key insights into regional market dynamics, significant shifts in property values, and the new areas entering the luxury and uber-luxury thresholds. Essential reading for investors and professionals navigating the complexities of high-end real estate.

As we dive into the latest data on the U.S. luxury real estate market, it becomes increasingly clear that understanding regional dynamics is crucial for professionals operating in this sector. This month’s comprehensive analysis highlights not only variations across different states but also identifies emerging regions showing significant growth potential in the upper-tier luxury market, emphasizing the importance of staying well-informed to effectively guide clients and tailor strategies.

National Overview

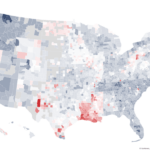

While the national average trend in property values exhibits notable stability, interspersed with minor fluctuations, these figures mask underlying regional differences. This overarching stability serves as a vital backdrop for our more focused analysis of regional trends, which reveals how specific areas, particularly in states like Wyoming, Maine, and California, are diverging from the national average due to distinct economic and demographic boosts.

Expansion into New Luxury Markets

This month, we spotlight the growth of new luxury markets, particularly in regions traditionally not recognized as luxury hubs. Our data indicates that cities like Alta, WY, and Rome, ME, are experiencing rapid appreciation, potentially entering the luxury space soon. This emergence of new luxury markets represents burgeoning opportunities for real estate professionals, requiring targeted marketing and customized service offerings.

Regional Variations and Their Implications

Our findings this month show diverse patterns in property value trends across various states, underlining the dynamic nature of the U.S. luxury real estate market. Cities such as Irvine, CA, continue to demonstrate strong growth, contrasting sharply with areas like Fish Camp, CA, and Highland Beach, FL, where markets are cooling. These variations are critical for developing effective strategies; markets on the rise demand a proactive approach to client advisory, focusing on timing and market readiness, while cooling markets require a cautious investment approach.

Strategic Insights for Real Estate Professionals

To navigate this complex landscape effectively, real estate professionals should consider several strategic approaches:

– Market Specialization: Developing expertise in specific high-growth areas can provide a competitive edge. Specializing in emerging luxury markets allows professionals to offer nuanced advice that resonates with affluent clients.

– Adaptive Marketing Strategies: Tailoring marketing efforts to align with the unique characteristics of rapidly changing markets can enhance visibility and attract high-net-worth individuals looking for exclusive property investments.

– Client Education: Keeping clients informed about the latest market trends and potential investment hotspots is essential for building trust and strengthening client relationships.

Recommendations for Enhancing Client Service

To better serve their clients and improve operational strategies, real estate professionals should embrace:

– Data-Driven Decision Making: Utilizing advanced analytics to understand and predict market trends can substantially increase the accuracy of client advice, identifying potential investment opportunities early.

– Customized Client Interactions: Personalizing interactions and services to meet the specific needs of luxury real estate clients can lead to higher satisfaction and loyalty.

– Strategic Networking: Building a robust network that includes architects, interior designers, and landscape artists can provide a comprehensive service package to clients looking to invest in luxury properties.

Looking Ahead

The U.S. luxury real estate market is poised for continued diversity in its growth patterns, offering both challenges and opportunities to those willing to adapt their strategies accordingly. While emerging markets may provide quick returns on investment due to their rapid growth, established but fluctuating markets offer long-term stability, appealing to different client bases.

Luxury real estate professionals need to remain vigilant and adaptable, utilizing a thorough understanding of national and regional market trends to optimize their service offerings. By focusing on emerging luxury markets and maintaining a client-centered approach, professionals can successfully navigate this complex market landscape, achieving both business growth and client satisfaction.

Here are some additional insights from the analysis of the upper-tier luxury property values over the last year:

Top Appreciating Cities:

- Alta, WY – This city saw the highest year-on-year growth, with property values increasing by over 23%. This could indicate a burgeoning market for luxury real estate, possibly driven by increased demand for secluded, scenic properties.

- Rome, ME and Glenwood Landing, NY – Both areas also experienced significant appreciation, suggesting a growing interest in these regions.

- Irvine, CA – Known for its master-planned communities, Irvine continues to show strong growth in the luxury sector, reinforcing its appeal to affluent buyers.

Top Depreciating Cities:

- Fish Camp, CA – This area saw the largest decrease in property values, with a year-on-year drop of over 17%. This decline might reflect market saturation or shifting preferences among luxury buyers.

- Highland Beach, FL and Sagaponack, NY – Both areas also saw considerable declines, which might suggest a cooling in what are traditionally very hot markets.

Strategic Insights:

– Emerging Markets: The substantial growth in places like Alta, WY, and Rome, ME suggests potential new opportunities for investment in luxury properties outside traditional hotspots.

– Market Adjustments: The depreciation in established markets like Fish Camp, CA, and Highland Beach, FL may require real estate professionals to adjust strategies, possibly shifting focus to rentals or alternative uses.

Market Predictions:

– Diversification: Real estate professionals might consider diversifying their portfolios by exploring emerging markets that show strong growth.

– Cautious Investments: In areas experiencing depreciation, careful analysis is required to understand the factors driving down property values, ensuring informed investment decisions.

Looking for our latest 12 month forecast down to the zip code? Follow this link

Year over Year National Luxury Real Estate Report Map:

Here are the recent Luxury Real Estate Report numbers for the data hounds:

US Luxury Real Estate Report Data April 2024

Methodology for RE Luxe Leaders Luxury Real Estate Report

The data used in the report is focused on the top one-third of markets in the United States, and is collected on a monthly basis. The data is used to identify trends in luxury real estate at the area level, rather than focusing on individual properties. The report aims to provide insight into luxury real estate trends across the country, by analyzing data from the most affluent and desirable markets in the United States.

We divide and define the US National Luxe Real Estate into three categories for our Luxury Real Estate Report:

- Executive Class. Areas where properties currently average sold prices of $750,000 and higher.

- Luxe. Areas where properties currently average sold prices of two million dollars and higher.

- Ultra-Luxe. Areas where properties currently average sold prices of five million dollars and higher.

Luxury Real Estate Report: Parting Thoughts

Embark on a Journey of Excellence in Luxury Real Estate

You’ve scratched the surface and glimpsed the transformative insights of luxury real estate. Now, we invite you to delve deeper. Our Luxury Certification Course is your gateway to becoming a connoisseur of high-end properties, an expert in refined client experiences, and a true leader in the market.

Why Join?

- Master the art of luxury transactions.

- Gain exclusive industry knowledge and cutting-edge strategies.

- Network with elite professionals and elevate your influence.

What Awaits You?

- Comprehensive training by seasoned experts.

- Practical tools for immediate application.

- A distinguished certification that sets you apart.

Ready to transcend the ordinary? Click Here to start your journey toward becoming a certified authority in luxury real estate.

For additional and real time insights, updates and news from our Founding and Managing Partner, Chris Pollinger, you can follow him on LinkedIn – Twitter – Facebook – Instagram