Feb 2024 Luxury Real Estate Report: Navigating the Complexities of the U.S. Luxury Real Estate Market

Explore the latest trends in the U.S. luxury real estate market, including the top metro areas and cities witnessing significant growth and decline in home values over $1 million. Gain insights into the factors influencing these changes and their implications for investors and professionals who work and play in luxury real estate.

In the ever-evolving landscape of the U.S. luxury real estate market, the period spanning from January 2023 to January 2024 has been particularly telling. Amidst a backdrop of economic fluctuations, changing lifestyles, and a global reassessment of what luxury living entails, this market segment has witnessed both remarkable growth and notable declines across various regions and cities. This analysis aims to unpack the intricate dynamics of these changes, shedding light on the metro areas and cities that have stood out as the biggest winners and losers in terms of the average percentage change in home value index for properties valued over $1 million. By diving into the factors driving these trends and their broader implications, we seek to offer a comprehensive overview of the current state and future outlook of the luxury real estate market, providing valuable insights for investors, real estate professionals, and high-net-worth individuals navigating this complex and nuanced landscape.

Feb 2024 Luxury Real Estate Report: Market Dynamics and Regional Highlights

In the backdrop of economic uncertainties, including inflation and fluctuating interest rates, certain metro areas have defied the odds, registering remarkable growth in luxury home values. Jackson, WY-ID and Coeur d’Alene, ID lead the pack with average increases of approximately 10.72% and 10.54%, respectively. These regions are followed closely by Madison, WI, Savannah, GA, and Sandpoint, ID, each showcasing the robustness and desirability of luxury properties within their markets. This growth is reflective of a combination of factors, including the scenic allure, relative privacy, and the evolving preference for spacious and secluded living spaces among affluent buyers.

Conversely, areas like Salisbury, MD-DE and Kennewick-Richland, WA experienced the steepest declines, with average decreases hovering around -12.90% and -11.61%. These downturns highlight regions facing challenges, potentially driven by economic shifts, changes in buyer preferences, or oversupply in the luxury market segment.

Feb 2024 Luxury Real Estate Report: Cities: Where Luxury Thrives and Declines

Drilling down to the city level, Alta, WY and Dover, ID stand out with impressive increases in home value indices of approximately 29.81% and 14.32%, underscoring the localized nature of real estate trends within the luxury segment. On the flip side, cities like South Bethany, DE and Waccabuc, NY saw significant reductions in their luxury home values, with declines of -18.41% and -18.21%, painting a picture of localized market adjustments or shifting preferences among luxury homebuyers.

Feb 2024 Luxury Real Estate Report: The Bigger Picture: Market Disparities and Economic Influences

These disparities between different regions and cities underscore the localized nature of the U.S. luxury real estate market. While some areas enjoy robust growth, driven by strong market conditions or increased desirability, others face declines, signaling potential concerns that warrant further investigation.

Recent market trends and developments have been significantly shaped by broader economic and sectoral influences. A record decline in luxury home sales, with a notable 38% year-over-year drop, marks a pivotal shift in the market dynamics, particularly in coastal markets such as Long Island, New York, and various Californian locales. Despite these sales downturns, the median sale price of luxury homes has risen in almost all metros, suggesting that while transaction volumes may have decreased, the value of luxury properties remains high in specific areas.

Feb 2024 Luxury Real Estate Report: Forward-Looking Insights for the Luxe Report

The current landscape of the luxury real estate market, characterized by its ups and downs, necessitates a comprehensive approach to analysis. Future market outlooks must consider early-stage indicators such as mortgage applications and interest rates to forecast potential recoveries or further declines. Moreover, the importance of localized market analyses cannot be overstated, as they offer valuable insights into the nuanced dynamics at play in various luxury real estate markets.

For real estate professionals and investors, navigating the current market conditions requires strategic recommendations, including pricing strategies, marketing approaches, and identifying investment opportunities in resilient or recovering markets. An examination of broader economic indicators and their impacts on the luxury real estate sector will be crucial, highlighting the need for agility and informed decision-making in the face of market uncertainties.

The U.S. luxury real estate market remains a complex and dynamic arena, shaped by a myriad of factors ranging from economic shifts to changing buyer preferences. As we move forward, understanding these trends and their implications will be key to navigating the luxury real estate landscape effectively, ensuring that stakeholders can adapt to and capitalize on the opportunities and challenges that lie ahead.

In the analysis over the period from January 2023 to January 2024, the metro areas that emerged as the biggest winners and losers in terms of the average percentage change in home value index for homes over $1 million are as follows:

Top 5 Metro Areas with the Highest Increase in Home Value Index

- Jackson, WY-ID: Experienced an average increase of approximately 10.72%.

- Coeur d’Alene, ID: Saw an average increase of about 10.54%.

- Madison, WI: Had an average increase of around 9.63%.

- Savannah, GA: Enjoyed an average increase of about 9.60%.

- Sandpoint, ID: Reported an average increase of approximately 9.46%.

Top 5 Metro Areas with the Highest Decrease in Home Value Index

- Salisbury, MD-DE: Faced an average decline of approximately -12.90%.

- Kennewick-Richland, WA: Experienced an average drop of around -11.61%.

- Ukiah, CA: Witnessed an average decrease of about -11.56%.

- Cape Coral-Fort Myers, FL: Saw a substantial average decrease of about -9.35%.

- Modesto, CA: Reported an average decrease of approximately -8.41%.

Top 5 Cities with the Highest Increase in Home Value Index

- Alta, WY: Experienced an increase of approximately 29.81%.

- Dover, ID: Saw an increase of about 14.32%.

- Harrison, ID: Had an increase of around 14.27%.

- La Canada Flintridge, CA: Enjoyed an increase of about 13.04%.

- Okoboji, IA: Reported an increase of approximately 12.94%.

Top 5 Cities with the Highest Decrease in Home Value Index

- South Bethany, DE: Faced a decline of approximately -18.41%.

- Waccabuc, NY: Experienced a drop of around -18.21%.

- Sanibel, FL: Witnessed a decrease of about -18.08%.

- Pescadero, CA: Saw a substantial decrease of about -17.93%.

- Boca Grande, FL: Reported a decrease of approximately -15.77%.

Looking for our latest 12 month forecast down to the zip code? Follow this link

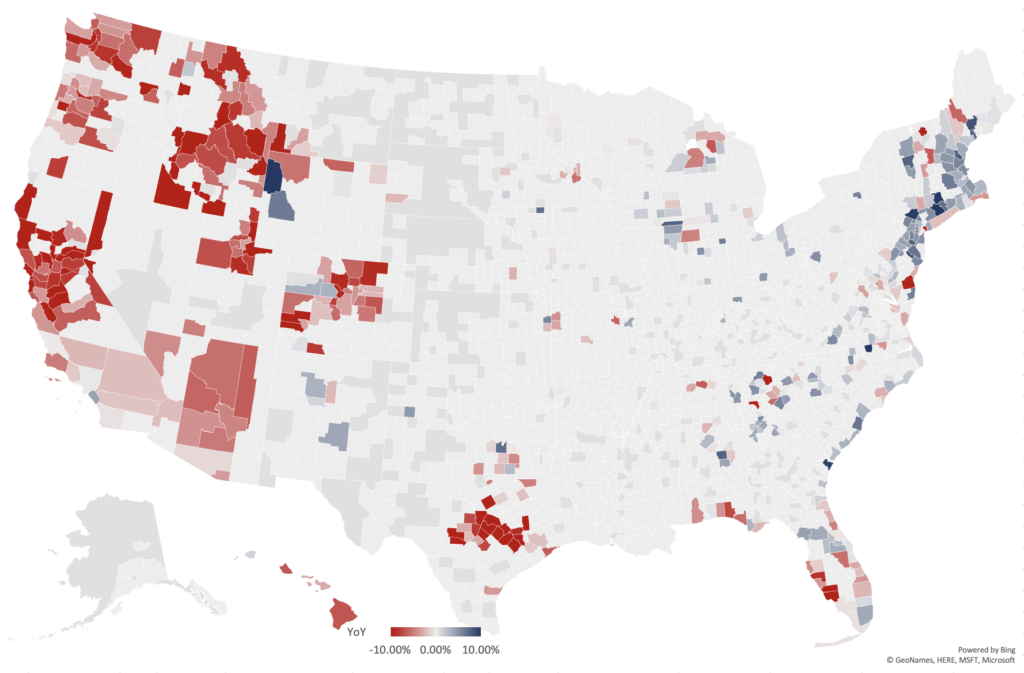

Year over Year National Luxury Real Estate Report Map:

Here are the recent Luxury Real Estate Report numbers for the data hounds:

Luxe Report Feb 2024 Data

Methodology for RE Luxe Leaders Luxury Real Estate Report

The data used in the report is focused on the top one-third of markets in the United States, and is collected on a monthly basis. The data is used to identify trends in luxury real estate at the area level, rather than focusing on individual properties. The report aims to provide insight into luxury real estate trends across the country, by analyzing data from the most affluent and desirable markets in the United States.

We divide and define the US National Luxe Real Estate into three categories for our Luxury Real Estate Report:

- Executive Class. Areas where properties currently average sold prices of $750,000 and higher.

- Luxe. Areas where properties currently average sold prices of two million dollars and higher.

- Ultra-Luxe. Areas where properties currently average sold prices of five million dollars and higher.

Luxury Real Estate Report: Parting Thoughts

Embark on a Journey of Excellence in Luxury Real Estate

You’ve scratched the surface and glimpsed the transformative insights of luxury real estate. Now, we invite you to delve deeper. Our Luxury Certification Course is your gateway to becoming a connoisseur of high-end properties, an expert in refined client experiences, and a true leader in the market.

Why Join?

- Master the art of luxury transactions.

- Gain exclusive industry knowledge and cutting-edge strategies.

- Network with elite professionals and elevate your influence.

What Awaits You?

- Comprehensive training by seasoned experts.

- Practical tools for immediate application.

- A distinguished certification that sets you apart.

Ready to transcend the ordinary? Click Here to start your journey toward becoming a certified authority in luxury real estate.

For additional and real time insights, updates and news from our Founding and Managing Partner, Chris Pollinger, you can follow him on LinkedIn – Twitter – Facebook – Instagram