January 2024 Luxury Real Estate Report: Navigating the Complexities of the U.S. Luxury Real Estate Market

Explore the ‘Luxury Real Estate Report Dec 2023’ to uncover the Top 8 Emerging Trends in U.S. Luxury Real Estate. Dive into our in-depth analysis to gain insights into regional dynamics, long-term growth patterns, and pivotal market shifts shaping the luxury sector in 2024.

The U.S. luxury real estate market continues to exhibit a complex and dynamic landscape as we step into 2024. This January Luxe Report builds upon the findings of the December 2023 report, integrating the latest data to provide a comprehensive analysis of market trends. Our focus remains on delivering insights that are crucial for investors, developers, and real estate professionals operating in the luxury segment.

January 2024 Luxury Real Estate Report: National Price Trends

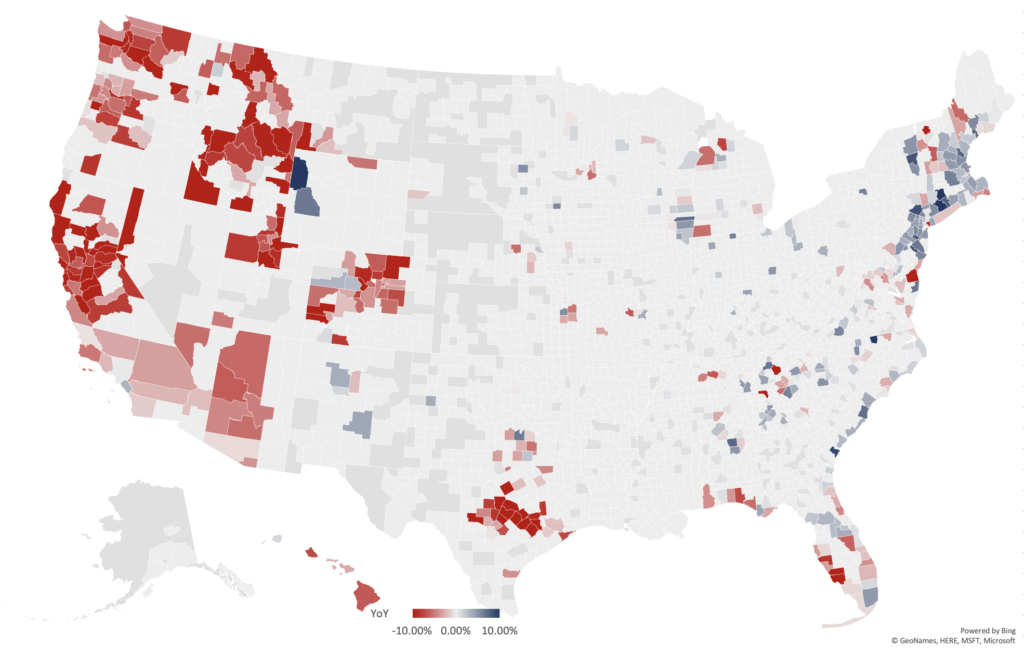

The tapestry of national price trends in the luxury real estate market is intricate. The latest Year-over-Year (YoY) changes indicate varied trends, with some areas experiencing significant declines, while others are witnessing notable increases. For instance, specific locales have seen declines as steep as -18.67%, while others have surged by up to 34.17%. These fluctuations underscore the nuanced nature of the luxury market, necessitating a detailed regional analysis for accurate market understanding.

January 2024 Luxury Real Estate Report: Year-Over-Year Changes

In the latest assessment, we observe striking differences in YoY changes across various regions. For example, a notable decline of -18.67% in certain high-profile luxury markets contrasts sharply with impressive gains, such as a 34.17% increase in emerging luxury locales. These figures highlight the volatility and opportunity within the luxury real estate sector. This diversity in market performance stresses the importance of geographic specificity in investment strategies.

January 2024 Luxury Real Estate Report: Long-Term Appreciation

Over a three-year span, regions have exhibited significant growth, with increases as high as 43.10%, 46.68%, and notably, 81.64% in some luxury markets. Over five years, this trend intensifies, with growth exceeding 50% and reaching an astounding 127.15% in certain areas. This continued upward trajectory over the medium to long term underscores the robust nature of luxury real estate as a resilient investment class.

January 2024 Luxury Real Estate Report: Decade-Long Growth

A decade-long perspective reveals even more pronounced growth. Some areas have experienced appreciation exceeding 100%, with figures like 113.97% and 135.84%, showcasing the luxury market’s potential for significant long-term value appreciation. This data is invaluable for investors looking at the long horizon, emphasizing the luxury real estate market’s capacity for sustained growth.

January 2024 Luxury Real Estate Report: National Market Dynamics

In assessing the overall market health, it’s evident that the luxury real estate market is undergoing a period of adjustment. The recent economic and demographic trends are influencing these dynamics, leading to a market that is both challenging and filled with opportunities. The luxury sector, while resilient, is not immune to broader economic conditions, and this interplay is critical for understanding the current state of the market.

January 2024 Luxury Real Estate Report: Regional Variations

The regional analysis in the luxury real estate market uncovers distinct trends. For instance, specific regions show a 5-year growth rate of 81.57% and 67.18%, indicating robust market health and investment potential. In contrast, some areas have experienced a decline, with a -9.65% change over a 10-year period, highlighting the market’s complexity and the need for detailed regional understanding.

January 2024 Luxury Real Estate Report: State-Specific Trends

The latest state-specific data offers fresh insights into the performance of different states within the luxury real estate market. States that were previously lagging might show signs of recovery, while others might be experiencing a slowdown. This state-level analysis is crucial for stakeholders who are looking to make informed decisions based on the latest market conditions.

January 2024 Luxury Real Estate Report: Market Risk Indicator

Reassessing the market’s risk, we observe notable shifts. Regions that have shown a 10-year growth rate of over 100% are considered lower risk and more stable for long-term investment. In contrast, areas with declines or minimal growth over the same period present higher risks and require cautious investment strategies.

The January 2024 Luxe Report underscores the complexity and dynamism of the U.S. luxury real estate market. The varied YoY changes, sustained long-term growth, and regional differences highlight the need for a nuanced approach to understanding and navigating this sector. For investors, developers, and real estate professionals, staying informed with the latest data and trends is key to making sound decisions in this ever-evolving market.

Looking for our latest 12 month forecast down to the zip code? Follow this link

Year over Year National Luxury Real Estate Report Map:

Here are the recent 2023 Luxury Real Estate Report numbers for the data hounds:

Luxe Report Jan 2024 Data

Methodology for RE Luxe Leaders Luxury Real Estate Report

The data used in the report is focused on the top one-third of markets in the United States, and is collected on a monthly basis. The data is used to identify trends in luxury real estate at the area level, rather than focusing on individual properties. The report aims to provide insight into luxury real estate trends across the country, by analyzing data from the most affluent and desirable markets in the United States.

We divide and define the US National Luxe Real Estate into three categories for our Luxury Real Estate Report:

- Executive Class. Areas where properties currently average sold prices of $750,000 and higher.

- Luxe. Areas where properties currently average sold prices of two million dollars and higher.

- Ultra-Luxe. Areas where properties currently average sold prices of five million dollars and higher.

Luxury Real Estate Report: Parting Thoughts

Embark on a Journey of Excellence in Luxury Real Estate

You’ve scratched the surface and glimpsed the transformative insights of luxury real estate. Now, we invite you to delve deeper. Our Luxury Certification Course is your gateway to becoming a connoisseur of high-end properties, an expert in refined client experiences, and a true leader in the market.

Why Join?

- Master the art of luxury transactions.

- Gain exclusive industry knowledge and cutting-edge strategies.

- Network with elite professionals and elevate your influence.

What Awaits You?

- Comprehensive training by seasoned experts.

- Practical tools for immediate application.

- A distinguished certification that sets you apart.

Ready to transcend the ordinary? Click Here to start your journey toward becoming a certified authority in luxury real estate.

For additional and real time insights, updates and news from our Founding and Managing Partner, Chris Pollinger, you can follow him on LinkedIn – Twitter – Facebook – Instagram