Luxury Real Estate Report Dec 2023: Top 8 Emerging Trends in U.S. Luxury Real Estate

Explore the ‘Luxury Real Estate Report Dec 2023’ to uncover the Top 8 Emerging Trends in U.S. Luxury Real Estate. Dive into our in-depth analysis to gain insights into regional dynamics, long-term growth patterns, and pivotal market shifts shaping the luxury sector in 2023.

In this edition of the Luxe Report, we dive into the multifaceted landscape of the U.S. luxury real estate market as of December 2023, integrating data from our comprehensive Luxe Report with the latest national insights. Our analysis reveals a complex and dynamic market, characterized by regional variations, long-term appreciation trends, and nuanced state-specific developments. From the robust growth in certain Northeastern states to the varied performance across cities like Alamo, CA, and Aledo, TX, the report offers a detailed examination of the current state and potential future trajectories of luxury real estate in the U.S. This synthesis of granular local data and broader national trends provides an invaluable perspective for investors, developers, and stakeholders navigating the intricacies of this high-value sector.

Luxury Real Estate Report Dec 2023: National Price Trends

The U.S. luxury real estate market, as reflected in the December 2023 Luxe Report, shows a complex tapestry of price trends across different regions. For instance, Agoura Hills, CA, stands out with an average price of $1,759,919, indicating a robust luxury market in this area. In contrast, cities like Acampo, CA, and Accord, NY, show more modest averages at $1,066,642 and $769,292, respectively. These figures demonstrate the significant variation in luxury real estate prices, highlighting the need for a nuanced understanding of each market. The disparity in prices across cities such as Alamo, CA ($3,119,930), and Aliso Viejo, CA ($1,296,925), further emphasizes the diverse nature of the luxury market in different geographical areas.

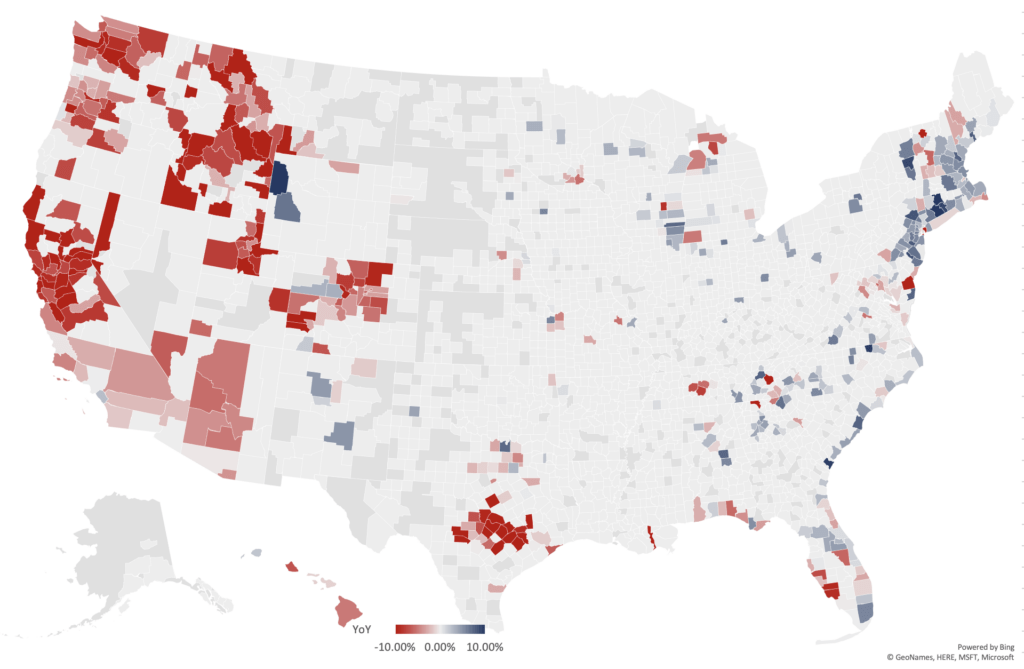

Luxury Real Estate Report Dec 2023: Year-Over-Year Changes

Year-over-year changes in the luxury real estate market indicate a mix of decreasing and increasing trends in different regions. For instance, Acampo, CA experienced a -10.76% change, while Aiea, HI saw a -5.22% decrease, suggesting possible market corrections or changes in local dynamics. Conversely, areas like Adirondack, NY, and Airmont, NY, have seen increases of 12.64% and 13.38%, respectively. These trends might be influenced by factors like local economic growth, demographic shifts, or changes in buyer preferences. The diversity in year-over-year changes across different regions underscores the importance of localized market insights.

Luxury Real Estate Report Dec 2023: Long-Term Appreciation

The 3-year and 5-year trends in the Luxe Report reflect sustained growth in property values in many areas. For example, over a 3-year period, Acton, MA, and Aliso Viejo, CA, have seen increases of 33.94% and 47.55%, respectively. Similarly, over a 5-year period, Ada, MI, and Allendale, NJ, have experienced growth of 57.63% and 83.03%, respectively. These trends suggest a stable and positive long-term outlook for the luxury real estate market in these regions. Such consistent growth over multiple years points to the resilience and investment potential of luxury properties in these areas.

Luxury Real Estate Report Dec 2023: Decade-Long Growth

The 10-year perspective in the Luxe Report highlights substantial appreciation in various markets. For instance, Aliso Viejo, CA, and Alpine, NJ, have witnessed growth of 91.29% and -9.27%, respectively, over a decade. This indicates a long-term positive trajectory for Aliso Viejo, while Alpine’s decrease might suggest market saturation or other local factors impacting prices. The substantial appreciation in most areas over a decade underscores the luxury real estate market’s potential as a stable and lucrative investment, reflecting broader economic and demographic trends over this period.

Luxury Real Estate Report Dec 2023: National Market Dynamics

The national trends in the luxury real estate market, as evidenced by the overall 4.7% year-over-year increase reported in October 2023, mirror the findings in the Luxe Report. This growth reflects a robust and resilient luxury segment. For example, Alamo, CA, with its high average price of $3,119,930, embodies the strength of the luxury market in certain high-demand areas. On the other hand, cities like Albany, CA, and Albion, CA, with more modest average prices, represent markets that are perhaps more sensitive to broader economic shifts, including mortgage rates and national economic trends. This national upward trend, despite varied local dynamics, indicates a solid underlying market health and enduring appeal of luxury real estate.

Luxury Real Estate Report Dec 2023: Regional Variations

The Northeast U.S., as highlighted in recent insights, shows the strongest price rebound, which is echoed in the Luxe Report. Cities like Airmont, NY, and Allendale, NJ, with year-over-year increases of 13.38% and 2.64% respectively, illustrate this regional strength. The hybrid work model’s impact on real estate patterns in the Northeast, requiring proximity to urban areas, can be seen in these examples. These regional variations demonstrate how local economic drivers and work arrangements significantly influence the luxury real estate prices and trends in specific areas.

Luxury Real Estate Report Dec 2023: State-Specific Trends

The Luxe Report reflects the state-specific trends observed nationally. For instance, Connecticut, with its high year-over-year increase, is represented by cities like Avon, demonstrating strong market demand. In contrast, states like Idaho and Texas, where declines are noted, can be seen in cities such as Ada and Aledo, respectively. These state-specific insights are critical, as they highlight the localized influences on the luxury real estate market, ranging from economic shifts to demographic changes.

Luxury Real Estate Report Dec 2023: Market Risk Indicator

The CoreLogic Market Risk Indicator’s prediction of potential price declines in specific areas aligns with the caution observed in some parts of the Luxe Report. For example, areas in Florida like Cape Coral-Fort Myers, which are flagged as high-risk, contrast with the more stable or growing markets in other states. Similarly, regions like Youngstown-Warren-Boardman, OH-PA, are also indicated as high-risk, suggesting potential market adjustments. These insights are invaluable for stakeholders to navigate the dynamic real estate sector, highlighting the need for vigilance and strategic planning in potentially volatile markets.

The December 2023 Luxury Real Estate Report underscores a period of significant transformation and opportunity within the U.S. luxury real estate market. The top 8 emerging trends reveal a landscape marked by regional growth variations, robust long-term appreciation, and nuanced market responses to economic and demographic shifts. These insights not only highlight the resilience and adaptability of the luxury real estate sector but also offer valuable guidance for stakeholders looking to navigate this complex and evolving market. As we move forward, understanding these trends will be crucial for making informed decisions and capitalizing on the potential that the luxury real estate market continues to offer.

Looking for our latest 12 month forecast down to the zip code? Follow this link

Year over Year National Luxury Real Estate Report Map:

Here are the recent 2023 Luxury Real Estate Report numbers for the data hounds:

Luxe Report Dec 2023

Methodology for RE Luxe Leaders Luxury Real Estate Report

The data used in the report is focused on the top one-third of markets in the United States, and is collected on a monthly basis. The data is used to identify trends in luxury real estate at the area level, rather than focusing on individual properties. The report aims to provide insight into luxury real estate trends across the country, by analyzing data from the most affluent and desirable markets in the United States.

We divide and define the US National Luxe Real Estate into three categories for our Luxury Real Estate Report:

- Executive Class. Areas where properties currently average sold prices of $750,000 and higher.

- Luxe. Areas where properties currently average sold prices of two million dollars and higher.

- Ultra-Luxe. Areas where properties currently average sold prices of five million dollars and higher.

Luxury Real Estate Report: Parting Thoughts

Embark on a Journey of Excellence in Luxury Real Estate

You’ve scratched the surface and glimpsed the transformative insights of luxury real estate. Now, we invite you to delve deeper. Our Luxury Certification Course is your gateway to becoming a connoisseur of high-end properties, an expert in refined client experiences, and a true leader in the market.

Why Join?

- Master the art of luxury transactions.

- Gain exclusive industry knowledge and cutting-edge strategies.

- Network with elite professionals and elevate your influence.

What Awaits You?

- Comprehensive training by seasoned experts.

- Practical tools for immediate application.

- A distinguished certification that sets you apart.

Ready to transcend the ordinary? Click Here to start your journey toward becoming a certified authority in luxury real estate.

For additional and real time insights, updates and news from our Founding and Managing Partner, Chris Pollinger, you can follow him on LinkedIn – Twitter – Facebook – Instagram