Luxury Real Estate Report: Nov 2023 – The Fall Season

Here is the current 2023 Luxury Real Estate Report by the staff at RE Luxe Leaders. At RE Luxe Leaders, we’re passionate about digging into the data to spotlight trends that empower you to make savvy business choices.

In the ever-evolving landscape of the U.S. luxury real estate market, our analysis of the November 2023 Luxury Real Estate Report reveals several critical trends and insights that are pivotal for informed decision-making.

Firstly, a deep dive into the average property values across a myriad of U.S. cities underscores the diverse valuation landscape. This comprehensive data, spanning from vibrant metropolitan areas to serene suburban locales, is a testament to the varying appeal and investment potential across regions. Such granular details are instrumental for investors and realtors, providing a clear picture of where the high-value markets are trending and the regional pricing dynamics at play.

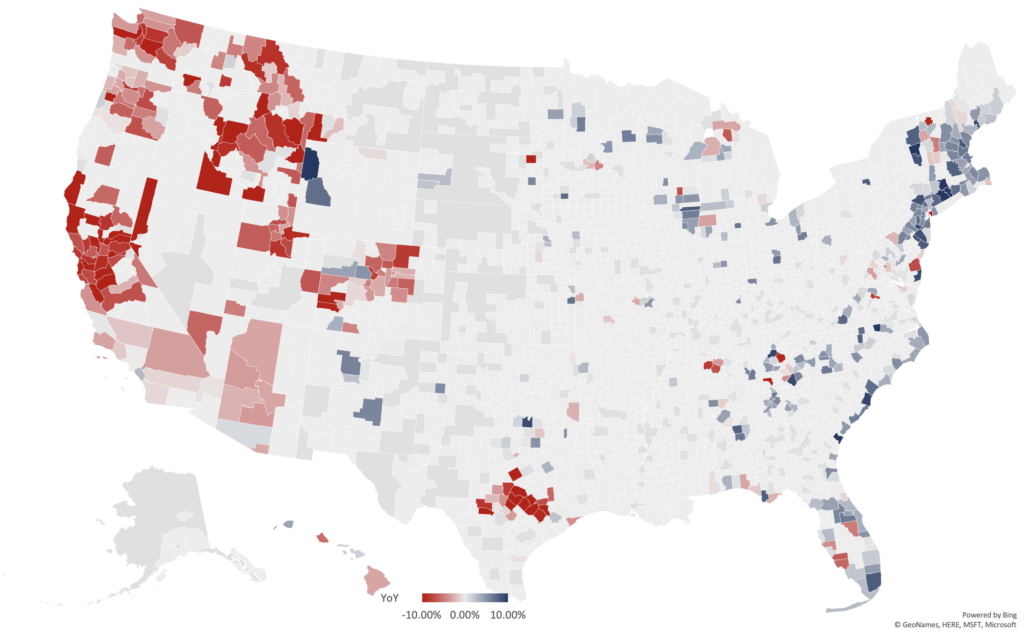

Turning our attention to the year-over-year percentage changes, we observe a landscape marked by notable fluctuations. This volatility is not just a mere statistic but a telling indicator of the market’s responsiveness to current economic and sociopolitical factors. Whether these fluctuations signal a bullish uptrend or a cautious downturn, they serve as a crucial barometer for those strategizing on a short-term basis.

The report’s three-year growth trends offer a lens into the medium-term market evolution. This period, encapsulating the post-pandemic recovery phase, sheds light on how various markets have adapted and transformed. It’s a critical insight for understanding resilience and adaptability in diverse real estate locales.

Moreover, the five-year growth patterns provide a broader perspective, highlighting consistent growth markets as opposed to those experiencing more recent volatility. This data layer is particularly relevant for stakeholders looking to gauge sustained market performance versus short-lived spikes.

Perhaps most telling is the decade-long market analysis. Here, we uncover the long-term trajectories of property values, offering a window into market stability and long-term capital appreciation potential. This longitudinal view is indispensable for investors whose strategies are anchored in long-term growth and stability.

The report also meticulously details city-specific insights, painting a vivid picture of the U.S. luxury real estate market’s multifaceted nature. From established high-end markets to burgeoning luxury hubs, this data is a goldmine for crafting targeted investment strategies and understanding the unique dynamics of regional markets.

Emerging luxury hubs, as indicated by significant growth in some lesser-known cities, present a frontier of opportunity. For investors and developers, these areas could offer a chance to pioneer and capitalize on nascent luxury markets.

Conversely, identifying regions with stagnant or declining values is equally crucial. This insight is not just about risk mitigation but also about understanding shifting consumer preferences and market saturation points.

The November 2023 Luxury Real Estate Report is not merely a collection of data points but a narrative of a dynamic and diverse market. It speaks of opportunities, cautions, and the ever-present need for a nuanced, informed approach in the luxury real estate domain. This report serves as a compass for navigating the complexities and capitalizing on the potential of the U.S. luxury real estate market.

Here are some specific highlights:

In an examination of the United States luxury real estate market as of October 30, 2023, we observe a landscape marked by both variety and grandeur. Leading the forefront is Jupiter Island, Florida, a distinguished locale within Martin County. Here, the average housing value reaches a remarkable $17.03 million, positioning it at the zenith of American luxury real estate. This area, part of the Port St. Lucie metro, epitomizes the upper echelon of residential opulence.

Closely following is Manalapan in Palm Beach County, Florida, where the average housing value stands at an impressive $15.98 million. Integrated into the Miami-Fort Lauderdale-Pompano Beach metro area, Manalapan is indicative of this region’s robust presence in the high-end market.

In the Pacific Northwest, Hunts Point, Washington, presents itself as a significant player. Located in King County and associated with the Seattle metro area, it boasts an average housing value of approximately $15.11 million. This figure underscores the region’s strong entry into the premium real estate segment.

Golden Beach in Miami-Dade County, Florida, further highlights the area’s luxury market prominence, with properties averaging around $12.98 million. This valuation reinforces the Miami metro area’s status as a prime destination for high-end real estate.

Atherton in California’s San Mateo County, situated in the heart of Silicon Valley, is noteworthy. With an average property value of about $12.93 million, it stands as a beacon of luxury in the San Francisco Bay Area.

Aspen, Colorado, renowned for its high-end ski resorts and amenities, maintains a significant position in Pitkin County with an average value of $11.75 million. This valuation confirms its standing as a premier destination for luxury living.

Sagaponack in Suffolk County, New York, part of the extensive New York-Newark-Jersey City metro area, demonstrates the Northeast’s sustained attraction in the luxury market, with an average housing value of approximately $11.55 million.

Fisher Island in Miami-Dade County, Florida, continues the state’s dominance in the luxury sector, showcasing an average housing value of around $10.86 million.

Additionally, Hanalei in Hawaii’s Kauai County, with an average value of about $9.15 million, and Beverly Hills in Los Angeles County, California, averaging approximately $9.12 million, both represent unique and highly sought-after markets within the national luxury real estate landscape.

These insights reflect a dynamic and diverse luxury real estate market in the United States, spanning various regions and offering a wide array of lifestyles, from coastal retreats to urban luxury and mountain getaways.

Looking for our latest 12 month forecast down to the zip code? Follow this link

Year over Year National Luxury Real Estate Report Map:

Here are the recent 2023 Luxury Real Estate Report numbers for the data geeks:

Luxe Report Nov 2023

Methodology for RE Luxe Leaders Luxury Real Estate Report

The data used in the report is focused on the top one-third of markets in the United States, and is collected on a monthly basis. The data is used to identify trends in luxury real estate at the area level, rather than focusing on individual properties. The report aims to provide insight into luxury real estate trends across the country, by analyzing data from the most affluent and desirable markets in the United States.

We divide and define the US National Luxe Real Estate into three categories for our Luxury Real Estate Report:

- Executive Class. Areas where properties currently average sold prices of $750,000 and higher.

- Luxe. Areas where properties currently average sold prices of two million dollars and higher.

- Ultra-Luxe. Areas where properties currently average sold prices of five million dollars and higher.

Embark on a Journey of Excellence in Luxury Real Estate

You’ve scratched the surface and glimpsed the transformative insights of luxury real estate. Now, we invite you to delve deeper. Our Luxury Certification Course is your gateway to becoming a connoisseur of high-end properties, an expert in refined client experiences, and a true leader in the market.

Why Join?

- Master the art of luxury transactions.

- Gain exclusive industry knowledge and cutting-edge strategies.

- Network with elite professionals and elevate your influence.

What Awaits You?

- Comprehensive training by seasoned experts.

- Practical tools for immediate application.

- A distinguished certification that sets you apart.

Ready to transcend the ordinary? Click Here to start your journey toward becoming a certified authority in luxury real estate.

For additional and real time insights, updates and news from our Founding and Managing Partner, Chris Pollinger, you can follow him on LinkedIn – Twitter – Facebook – Instagram