Luxury Real Estate Report: Oct 2023 – The Luxury Real Estate Renaissance in North America

Here is the current 2023 Luxury Real Estate Report by the staff at RE Luxe Leaders. At RE Luxe Leaders, we’re passionate about digging into the data to spotlight trends that empower you to make savvy business choices.

Luxury Real Estate Report: The Luxury Real Estate Renaissance in North America

The North American luxury real estate market is undergoing a transformation, guided by key trends and shifts. These factors are reshaping the sector, offering new perspectives and opportunities.

Luxury Real Estate Report: The Demographic Powerplay

Ultra-high-net-worth individuals, with their vast financial arsenals, are emerging as central players. Their diversified portfolios not only testify to their financial acumen but also their belief in the enduring allure of luxury real estate.

Luxury Real Estate Report: Evolving Purchasing Behaviors

Real estate, more than just a physical asset, is witnessing a surge in its intrinsic value. This elevation is driven by myriad factors: evolving lifestyles, the ascent of the new millionaire generation, and a growing penchant for secondary homes. These undercurrents signal a profound shift in perceptions and desires.

Luxury Real Estate Report: The Rise of Multiple Home Ownership

Owning a single luxury property is passé. The new American elite, especially Gen-X and millennials, are setting their sights on multiple properties. Prime regions such as New York City and Silicon Valley have become coveted territories in this new quest.

Luxury Real Estate Report: The Global Context

As the globe witnesses a surge in millionaires, and immigration, the U.S. remains a beacon for affluent international buyers. The crossroads of wealth, these traditional U.S. centers are at the epicenter of a global luxury real estate movement.

Luxury Real Estate Report: The Nuances of Buyer Priorities

For the discerning affluent buyer, priorities are evolving. While location remains paramount, there’s a growing emphasis on the condition and amenities of the property. Homes that offer breathtaking vistas, embody superior construction quality, and guarantee privacy are especially sought after. Additionally, the modern luxury home is tech-savvy, echoing the desires of a digitally-native clientele.

Luxury Real Estate Report: The Reshaping Economic Landscape

Post-pandemic, luxury properties are not merely architectural marvels but vital components in the portfolios of the affluent. HNW and UHNW individuals are reshaping their strategies as they navigate challenges such as inflationary pressures, equity portfolio depreciation, and potential recessions. The past’s economic certainties seem to waver in the face of these emerging concerns, prompting a re-evaluation of luxury investments.

Luxury Real Estate Report: Geopolitical Conflicts and Real Estate

Far from the pristine facades of luxury homes, geopolitical conflicts in regions like Ukraine and Israel are indirectly influencing the luxury real estate market. The issuance of bonds to finance these wars can have cascading effects on global financial systems. The indirect repercussions may manifest in international investment behaviors, possibly impacting the luxury real estate sector.

Luxury Real Estate Report: A Divided U.S. Political Arena

The U.S. political scene, often a backdrop for many investment decisions, is undergoing significant shifts. With RFK’s decision to run as an independent, the 2024 presidential race promises to be a riveting three-way contest. Such political divides can introduce uncertainties, and investors in the luxury real estate market may tread with heightened caution.

Luxury Real Estate Report: Unraveling Economic Concerns

The luxury market, while opulent, is not immune to broader economic undercurrents. A confluence of factors – from stock market jitters to potential interest rate hikes – is steering the market in unforeseen directions. Additionally, shifts in industries like tech and finance, which often produce the new generation of luxury buyers, could recalibrate demand and supply in the market.

Luxury Real Estate Report: The Inventory Dilemma

A persistent challenge for the luxury real estate sector is the availability of suitable inventory. Stemming from the 2008 financial crisis and exacerbated by the pandemic’s housing boom, this issue remains unresolved. With limited options, buyers and investors may need to recalibrate their expectations or explore emerging luxury hubs.

Luxury Real Estate Report: This month’s analysis

In an analysis of luxury real estate markets across the country, certain national averages and city-specific trends emerge. The nation’s top-tier averages show a year-over-year (YoY) decrease of 2.14%, but when we look at longer timeframes, the growth is undeniable: a 28.58% increase over 3 years, 39.06% over 5 years, and a robust 64.28% over 10 years. Comparatively, the luxe avenue properties slightly outperformed these averages, especially over a 10-year period with a 75.52% increase.

Diving into specific cities and states, the luxury real estate landscape offers a mosaic of performance metrics. Jupiter Island, FL, despite experiencing an 11.96% YoY dip, saw an impressive 54.26% growth over 3 years and 84.90% over a decade. Hunts Point, WA, with its current average property value at $15,128,731, witnessed a whopping 101.03% growth over 10 years.

Florida remains a hotspot for luxury properties. Manalapan, FL, had a 139.82% growth over 10 years, while Fisher Island, FL, saw a 79.29% growth in the same period. Meanwhile, Atherton, CA, despite its current high average value of $12,879,900, had a relatively modest 52.69% growth over a decade.

Hawaii’s Hanalei stands out with a unique statistic: its 5 and 10-year growth percentages are both at 0.00%. Beverly Hills, CA, an iconic luxury destination, has shown significant resilience with a 140.50% increase over the past decade. On the other hand, Palm Beach, FL, with an average property value of nearly $9 million, has displayed a remarkable 213.11% growth over 10 years.

The data also revealed intriguing trends in some lesser-known luxury hubs. For instance, Yarrow Point, WA, had a 10-year growth of 135.14%, while Lake Buena Vista, FL, despite its recent 5.25% YoY growth, showed no growth data for the 3, 5, or 10-year marks.

California cities like Los Altos Hills and Ross showcased a decade-long growth of 52.50% and 58.99%, respectively. Meanwhile, the East Coast had its stars too. Sagaponack, NY, with an average property value of over $11 million, had a more modest 37.94% growth over 10 years.

As we move to properties with values ranging from $5 million to $7 million, cities like Wilson, WY, and Woodside, CA, show growths of 158.43% and 55.97% over a decade, respectively. Belvedere, CA, in the $6 million range, had a 10-year growth of 44.33%.

Interestingly, some cities, like Hanalei, HI, and Southampton, NY, show a 0.00% growth in multiple periods, indicating stable property values. Conversely, places like Palm Beach, FL, and Jupiter Inlet Colony, FL, with their triple-digit growth rates over a decade, highlight the dynamic nature of the luxury real estate market.

The list continues with cities showcasing a blend of growth patterns. From Clyde Hill, WA’s 131.00% 10-year growth to Wainscott, NY’s -2.67% over 5 years, the luxury market’s diversity is evident.

In conclusion, while the national averages provide a broad perspective, the real insights lie in the city-specific data. The luxury real estate market, with its blend of established hotspots and emerging destinations, continues to be a dynamic and intriguing sector, offering both challenges and opportunities for investors and homeowners alike.

Overall Market Trends:

- Top Tier National Averages show a slight decline year-over-year (-2.14%) but have significantly grown over longer periods: 28.58% over 3 years, 39.06% over 5 years, and 64.28% over 10 years.

- Luxe Average follows a similar trend with a slight decline year-over-year (-2.10%) but has witnessed a strong growth over 3 years (35.19%), 5 years (44.52%), and 10 years (75.52%).

City-Specific Observations:

- Highest Average Property Value: Jupiter Island, FL tops the list with an average property value of $17,380,458.

- Largest Year-over-Year Decrease: Hunts Point, WA experienced the largest YoY decline in average property value at -17.17%.

- Largest 10-Year Increase: Palm Beach, FL has seen a staggering increase in average property values over the past 10 years, with a growth of 213.11%.

- Stagnant Growth: Hanalei, HI and Southampton, NY have shown no growth over 5 and 10 years, indicating a possible stagnation in the luxury property market in these areas.

- High Growth in Short Term: Jupiter Inlet Colony, FL has an impressive 3-year growth of 102.96%, which is notably high compared to most other cities on the list.

- Decrease in Longer Term: Wainscott, NY shows a negative growth over 10 years, indicating a decline in luxury property value over the decade.

Additional Insights:

- Volatility: Some cities like Beverly Hills, CA, and Palm Beach, FL show massive growth over 10 years (140.50% and 213.11% respectively) despite negative YoY growth.

- Potential Emerging Markets: Some cities, like Golf, FL and Anna Maria, FL, have experienced rapid growth over the past 3, 5, and 10 years, suggesting that they are emerging luxury markets.

- Stable Growth: Cities like Aspen, CO and Beverly Hills, CA have shown consistent growth across the 3, 5, and 10-year marks, indicating stability in the luxury property market in these areas.

Looking for our latest 12 month forecast down to the zip code? Follow this link

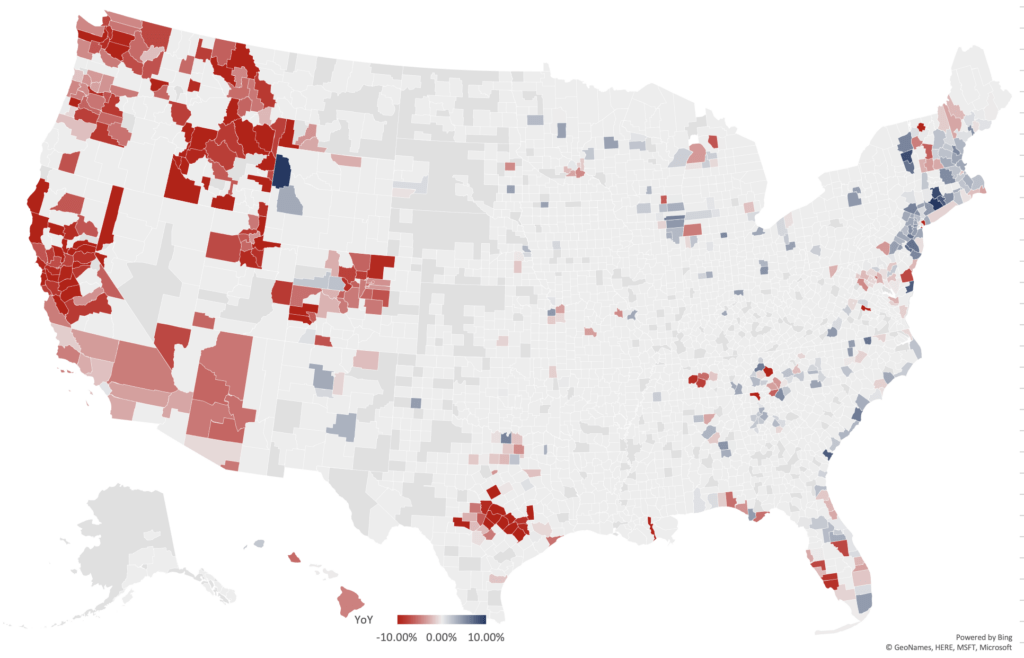

Year over Year National Luxury Real Estate Report Map:

Here are the September 2023 Luxury Real Estate Report numbers for the data geeks:

Luxury Real Estate Report Data – Oct 2023

Methodology for RE Luxe Leaders Luxury Real Estate Report

The data used in the report is focused on the top one-third of markets in the United States, and is collected on a monthly basis. The data is used to identify trends in luxury real estate at the area level, rather than focusing on individual properties. The report aims to provide insight into luxury real estate trends across the country, by analyzing data from the most affluent and desirable markets in the United States.

We divide and define the US National Luxe Real Estate into three categories for our Luxury Real Estate Report:

- Executive Class. Areas where properties currently average sold prices of $750,000 and higher.

- Luxe. Areas where properties currently average sold prices of two million dollars and higher.

- Ultra-Luxe. Areas where properties currently average sold prices of five million dollars and higher.

Luxury Real Estate Report: Parting Thoughts

We hope that the information provided is helpful in guiding you on your journey to building a thriving real estate business.

As luxury real estate consultants, coaches and advisors for Proptech, Fintech, Brands, Brokerages, Teams and Elite agents, we are confident that our resources, insights and strategies can help you achieve your goals.

Remember, success in the luxury real estate industry starts with knowledge and strategy, and we are here to provide you with both.

Here are some links to our more popular resources:

- Real Estate Insights from our luxury real estate consultants to help you out position your competitors

- Downloads and Tools To Accelerate the Growth of Your Real Estate Business from our amazing luxury real estate coaches

- Exclusive Luxe Real Estate Reports and Forecasts to give you an edge

- Luxury Real Estate AI Tools we have specifically trained to make your life easier

If you’re wondering what consulting or coaching solutions we offer, we’ve set up a handy wizard to guide you to the ideal options that would be tailored to your situation.

For additional and real time insights, updates and news from our Founding and Managing Partner, Chris Pollinger, you can follow him on LinkedIn – Twitter – Facebook – Instagram