Luxury Real Estate Outlook: June 2023 – A Guide to Success in the US Market

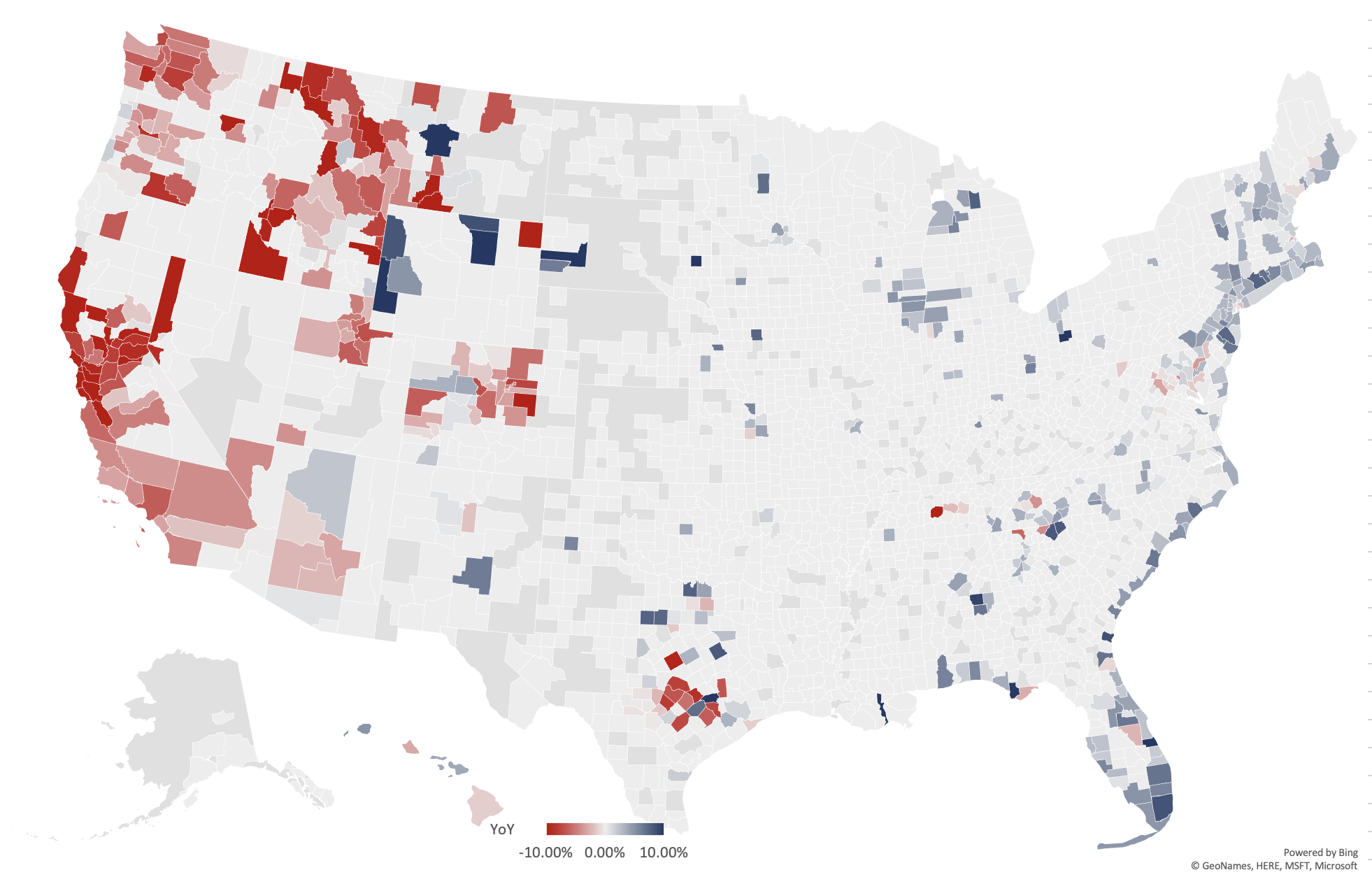

At RE Luxe Leaders, we’re passionate about digging into the data to spotlight trends that empower you to make savvy business choices. Interestingly, we’re observing a tale of two markets as opposed to one national trend. The luxury market power centers are evolving, driven by the migration of wealth over the past year.

Luxury Real Estate Report: The Two-Sided Coin of the Luxury Market

The top of the national market has experienced a slight decrease of -.88%, with an average price landing at $514,653. This dip is largely due to fluctuations in California’s Ultra High-end market. While the Executive Class Luxe shows a year-over-year performance at -.88%, the Luxe Class (properties valued at $2 million+) reveals a decline of -1.55%. Properties over $5 million are witnessing a modest drop of -.96%. It’s important to note, these trends vary widely from region to region and coast to coast.

Luxury Real Estate Report: The Inventory Conundrum

Despite signs of market recovery, inventory is struggling to catch up. In most regions, we’re noting a significant decline in inventory compared to 2019 levels. This scarcity is even more striking as we move into the seasonally high demand period. Furthermore, we’re witnessing considerable price depreciation in specific areas, mainly within large urban cities. Interestingly, the west coast appears to be recovering, showing signs of an upward trend.

Luxury Real Estate Report: New Horizons in the Luxury Market

In a promising development, 83 new areas crossed into the executive luxury threshold over the past month, indicating that the luxury market is stabilizing and prices are starting to climb again. Additionally, 7 new regions recently crossed the $2 million+ threshold, reflecting the continued wealth migration into these burgeoning power areas.

Luxury Real Estate Report: A Look at the Bigger Picture

Delving into long-term data gives us even more reasons for optimism. The three-year average growth rate for luxury real estate stands at an impressive 32.26%, the five-year average hits a remarkable 43.24%, and the ten-year average is at a robust 78.25%. These statistics clearly show that luxury properties have consistently outperformed lower price ranges in terms of percentage return.

Luxury Real Estate Report: A Few Insights on the International Luxury Market

Current research on the international luxury real estate market offers several key insights. The core definition of luxury has significantly changed over the past few years, and ultra-high-net-worth individuals are now a significant driving force in the luxury home buying market. These individuals, with their diversified investment portfolios, will continue to have significant influence in the market in the coming years.

The intrinsic value of purchasing real estate has never been higher, with wealthy buyers being motivated by lifestyle changes and opportunities in the current market environment. We anticipate a high volume of international buyers, a growing influence among younger millionaires, and a continued appetite for secondary homes.

Ownership of multiple homes, both in the U.S. and abroad, is becoming a trend among wealthy individuals. 72% of wealthy buyers said their future home purchase would be a second residence, vacation home, or rental property. Notably, Gen-X and millennials are leading the way in this trend. Furthermore, the propensity to own a home abroad is on the rise due to the strength of the U.S. dollar and rising costs of U.S. living. Europe, Central America, and Asia are among the increasingly popular locations for these buyers.

Additionally, the number of global millionaires is at its highest point in history and is expected to surge by 40% by 2026. Major U.S. markets and traditional centers of wealth, continue to be a significant draw for affluent international buyers. Cities in Asia, such as Singapore, Beijing, and Guangzhou, have regained their position in the top global cities with primary and secondary homeowners as borders have reopened.

When it comes to the factors influencing the choices of luxury real estate buyers, property location, home condition, and amenities rank as the highest priorities. Open floor plans, bespoke architectural elements, neutral color palettes, and tech-friendly homes with automation systems, energy-efficient appliances, and electric vehicle charging stations are among the top trends.

Luxury Real Estate Report: Navigating the Luxury Real Estate Landscape

In the luxury real estate market, it’s all about identifying opportunities and staying one step ahead. By closely monitoring trends and leveraging the insights we’ve shared here, you’re positioning yourself for growth and success in this thrilling industry. Remember, in real estate, as in life, the key to success lies in understanding the terrain and charting your path with confidence and foresight.

Luxury Real Estate Report: Diving Deeper: Keynote Insights

Recently, we conducted a keynote presentation where we delved deeper into these trends. If you’re interested in gaining valuable insights from our research and analysis, you can access it here.

Looking for our latest 12 month forecast down to the zip code? Follow this link

Year over Year National Luxury Real Estate Report Map:

Here are the June 2023 Luxury Real Estate Report numbers for the data geeks:

Luxury-Real-Estate-Report-Data-June-2023

Methodology for RE Luxe Leaders Luxury Real Estate Report

The data used in the report is focused on the top one-third of markets in the United States, and is collected on a monthly basis. The data is used to identify trends in luxury real estate at the area level, rather than focusing on individual properties. The report aims to provide insight into luxury real estate trends across the country, by analyzing data from the most affluent and desirable markets in the United States.

We divide and define the US National Luxe Real Estate into three categories for our Luxury Real Estate Report:

- Executive Class. Areas where properties currently average sold prices of $750,000 and higher.

- Luxe. Areas where properties currently average sold prices of two million dollars and higher.

- Ultra-Luxe. Areas where properties currently average sold prices of five million dollars and higher.

A Parting Thought

We hope that the information provided is helpful in guiding you on your journey to building a thriving real estate business.

As luxury real estate consultants, coaches and advisors for Proptech, Fintech, Brands, Brokerages, Teams and Elite agents, we are confident that our resources, insights and strategies can help you achieve your goals.

Remember, success in the luxury real estate industry starts with knowledge and strategy, and we are here to provide you with both.

Here are some links to our more popular resources:

- Real Estate Insights from our luxury real estate consultants to help you out position your competitors

- Downloads and Tools To Accelerate the Growth of Your Real Estate Business from our amazing luxury real estate coaches

- Exclusive Luxe Real Estate Reports and Forecasts to give you an edge

- Luxury Real Estate AI Tools we have specifically trained to make your life easier

If you’re wondering what consulting or coaching solutions we offer, we’ve set up a handy wizard to guide you to the ideal options that would be tailored to your situation.

For additional and real time insights, updates and news from our Founding and Managing Partner, Chris Pollinger, you can follow him on LinkedIn – Twitter – Facebook – Instagram