10 Principles to Master Needs Analysis in Luxury Real Estate Sales 10 Principles to Master Needs Analysis in Luxury Real Estate Sales Unlock unparalleled client insight and elevate luxury real

7 Ways Empathy Elevates Sales in Luxury Real Estate 7 Ways Empathy Elevates Sales in Luxury Real Estate Behind every luxury property transaction lies a quiet tension familiar to brokerage

Maximize Your Team’s Potential with Our Brokerage Recruiting Calculator Insights from a Real Estate Recruiting Coach Discover how our Brokerage Recruiting Calculator can help you attract top talent and

7 Principles to Foster Successful Work-Life Balance in Real Estate Leadership 7 Principles to Foster Successful Work-Life Balance in Real Estate Leadership Strategic insights for luxury real estate leaders to

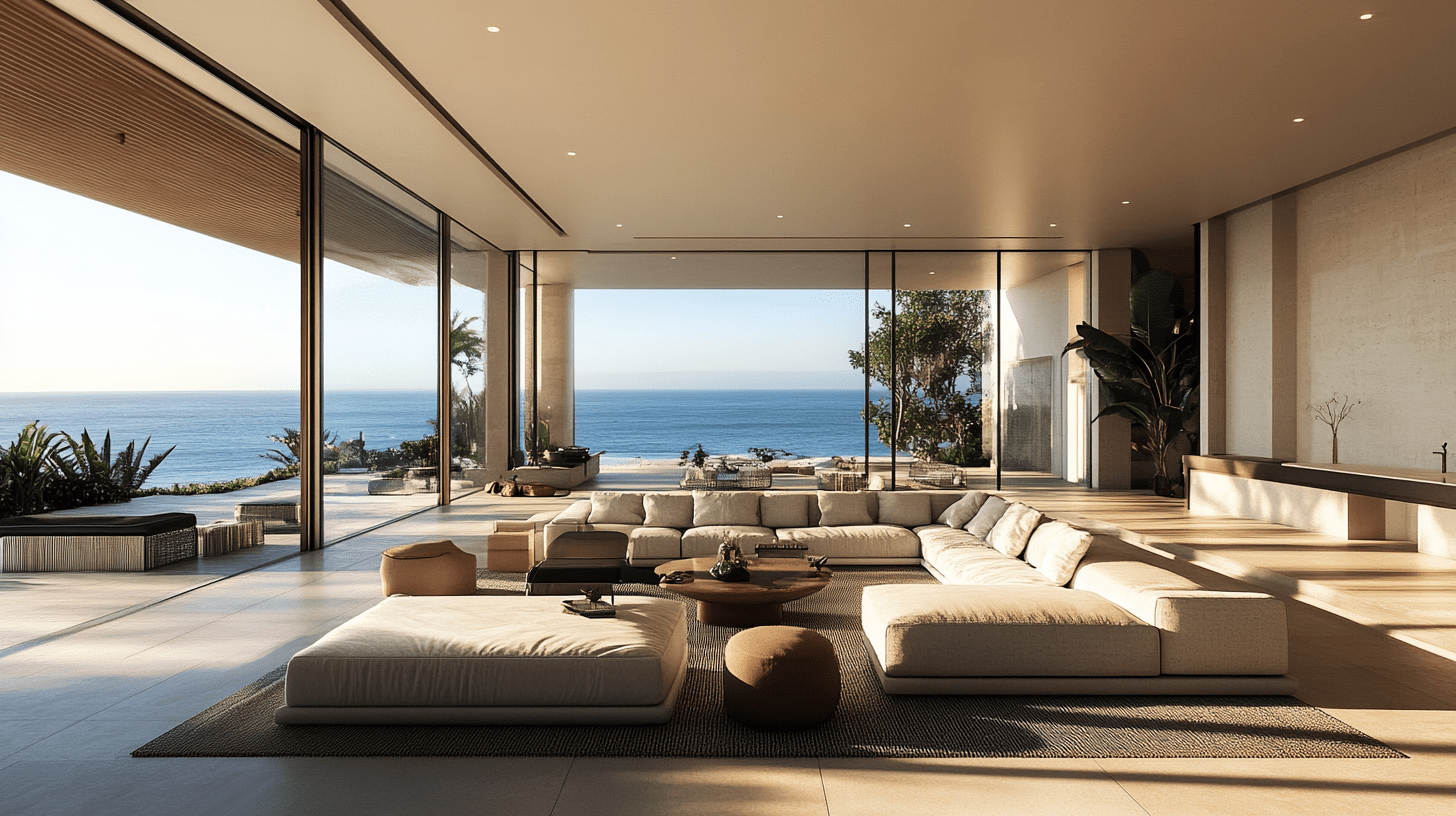

5 Top Tax-Free Havens for Luxury Real Estate Investment Discover five top tax-free havens for luxury real estate investment. Our global network of expert agents can help you secure the

8 Proven Leadership Strategies to Elevate Luxury Real Estate Teams 8 Proven Leadership Strategies to Elevate Luxury Real Estate Teams Essential strategies for elite brokers and team leaders to sustain