Margins are being tested. Lead costs are up, splits are sticky, and cycle times stretch when lenders, appraisers, and ops aren’t aligned. Most teams respond with volume goals. The operators

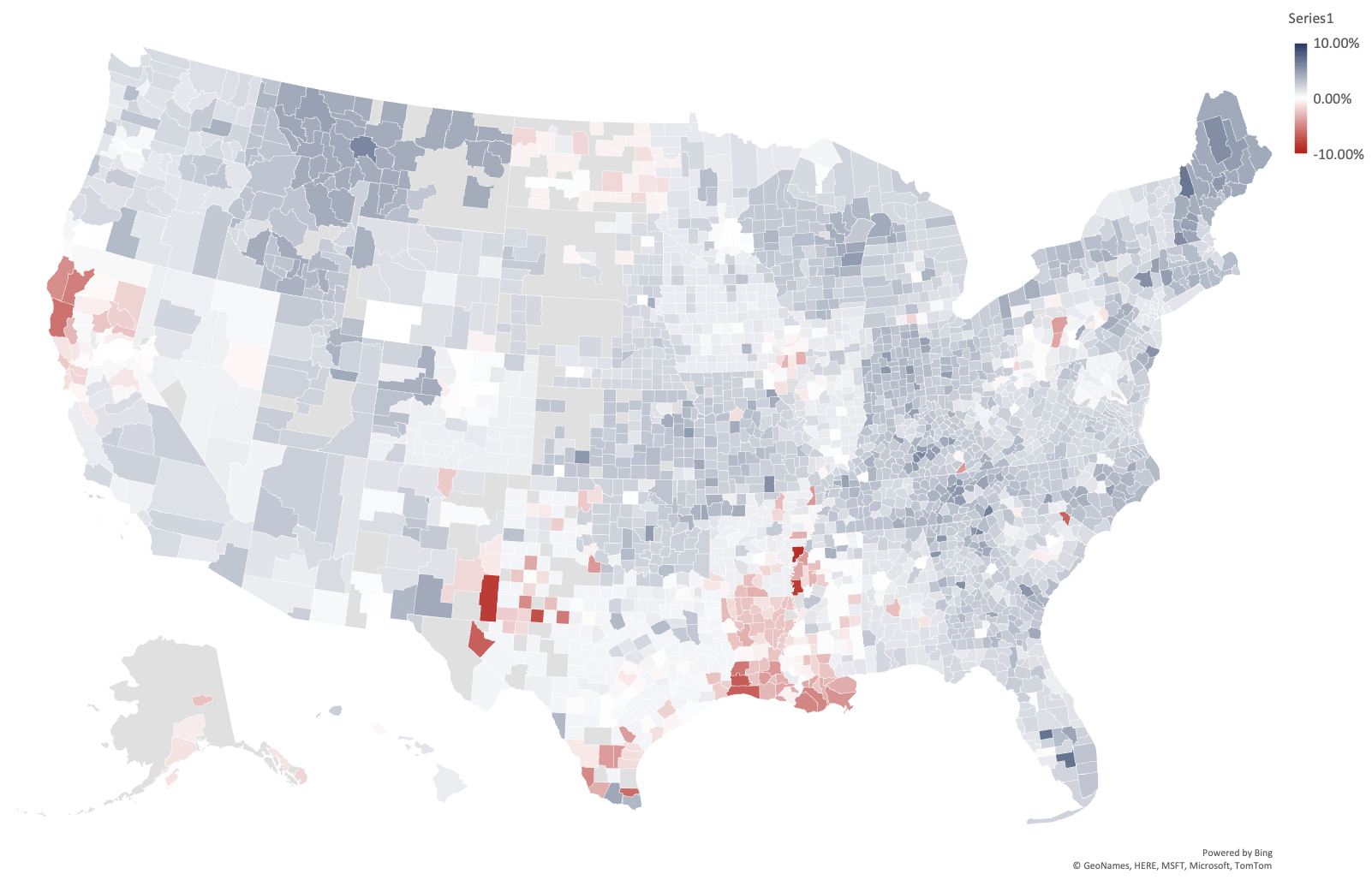

December 2024 National Real Estate Forecast: Insights and Trends for 2025 Explore our National Real Estate Forecast for 2025 for comprehensive insights into the U.S. luxury real estate market.

Top operators aren’t asking how to sell more. They’re asking how to keep more. Volume without discipline masks margin decay—split pressure, rising lead costs, and longer cycle times quietly compress

Top-producing firms aren’t confused about where results come from. They run on discipline, not inspiration. If your weeks feel long, your numbers look lumpy, and meetings drift without decisions, you

Top producers and brokerage operators don’t need more motivation—they need a brokerage operating system that converts strategy into repeatable performance. If your profit swings with market cycles, it’s not the

Rapid growth without structure is expensive. Margin drift, lead sprawl, and people problems compound as volume rises. If your leadership meetings chase fires instead of driving priorities, the issue isn’t

Growth without a backbone is expensive. Many firms add headcount, tools, and lead sources faster than they add discipline. Margin erodes, decisions slow, and quality wobbles at scale. The fix

Most brokerages measure what’s easy—sides, headcount, and gross commission income. Then they wonder why revenue grows while profit stalls. The gap isn’t effort. It’s instrumentation. If you don’t manage to

November 2024 National Real Estate Forecast: Post Election Updated Insights and Trends Explore our National Real Estate Forecast for 2024 for comprehensive insights into the U.S. luxury real estate

Top producers don’t need more tools—they need a coherent real estate brokerage operating system that aligns people, process, and profit. If your weekly meeting is a parade of ad-hoc updates,