Top teams don’t win on motivation. They win on operating discipline. If your P&L swings with individual production, if pipeline reviews turn into story time, or if compensation rewards volume

“`html Mastering Luxury Real Estate Team Building: 10 Strategies for High-Performance Success How to Build a Powerful, Dynamic, and Interdependent Team The Evolution from Independent to Interdependent Establishing a Culture

Top firms aren’t winning on motivation or brand polish. They’re winning on operating discipline. If your P&L swings on recruiting seasons, lead flows, or a few whales, you don’t have

Top 7 Expense Cutting Strategies for Luxury Real Estate Teams in 2025 Top 7 Expense Cutting Strategies for Luxury Real Estate Teams in 2025 Insights from a Luxury Real Estate

7 Essential Steps to Move Your Real Estate Team Successfully | RE Luxe Leaders™ 7 Essential Steps to Move Your Real Estate Team Successfully Relocating or restructuring your luxury real

“`html The 8-Step Path to Greatness in Luxury Real Estate Discipline Breeds Habits Habits Lead to Consistency Consistency Fuels Growth Growth Fosters Resilience Resilience Builds Confidence Confidence Inspires Action Action

8 Hard Truths to Master Success in Luxury Real Estate Mastering Success in Luxury Real Estate: 8 Hard Truths Every Agent Needs to Know Thriving in luxury real estate requires

Top teams aren’t confused about what to watch. They run a tight cadence around a short list of real estate operating metrics that predict revenue, protect margin, and expose capacity

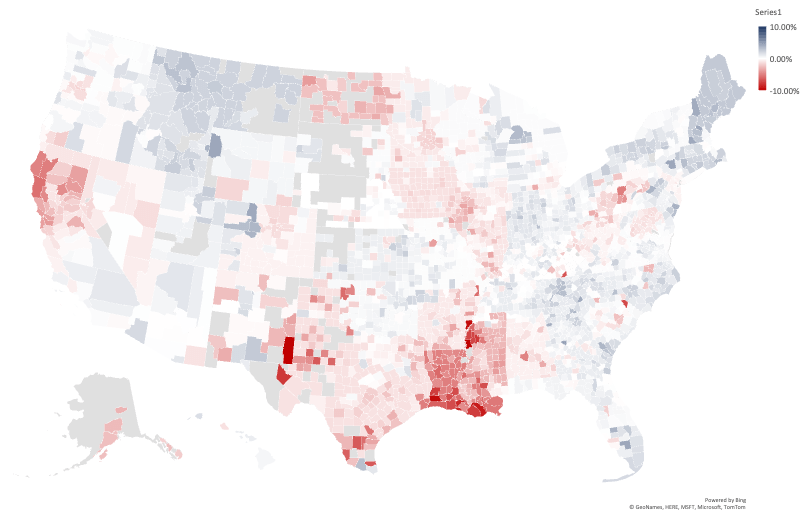

October 2024 National Real Estate Forecast: Updated Insights and Trends Explore our National Real Estate Forecast for 2024 for comprehensive insights into the U.S. luxury real estate market. Stay

Top operators don’t guess. They run the week by numbers. If you’re leading a seven-figure team, you already know activity volume alone is not a strategy. What matters is the