Master Time Management: Tailored Time Management Strategies for Real Estate Professionals Discover personalized time management strategies for real estate professionals. Learn how to harness your strengths—whether you’re a Social Butterfly,

5 Reasons to Lead a Dream Team, Not a Family in Luxury Real Estate Do You Run a Dream Team or a Family? Are you leading a high-performance dream team

4 Strategies to Keep Your Real Estate Brokerage Ahead as Clients Evolve 4 Strategies to Keep Your Real Estate Brokerage Ahead as Clients Evolve Expert insights from Chris Pollinger, Managing

8 Proven Efficiency Hacks to Boost Productivity for Luxury Real Estate Professionals 8 Proven Efficiency Hacks to Boost Productivity for Luxury Real Estate Professionals Powerful time-saving strategies designed to elevate

9 Proven Strategies to Keep Retention Rates High When Business Is Slow Chris Pollinger shares nine effective strategies to maintain high retention and keep your real estate agents engaged, motivated,

6 Strategic Cash Flow Tips to Keep Your Luxury Real Estate Business in the Green 6 Strategic Cash Flow Tips to Keep Your Luxury Real Estate Business in the Green

5 Strategies to Master Parkinson’s Law & Boost Efficiency in Luxury Real Estate Mastering Parkinson’s Law: Boosting Efficiency in Luxury Real Estate Insights from a Luxury Real Estate Coach The

If your P&L widened on revenue but tightened on margin last year, you don’t have a sales problem—you have an operating problem. Too many firms add agents, tech, and headcount

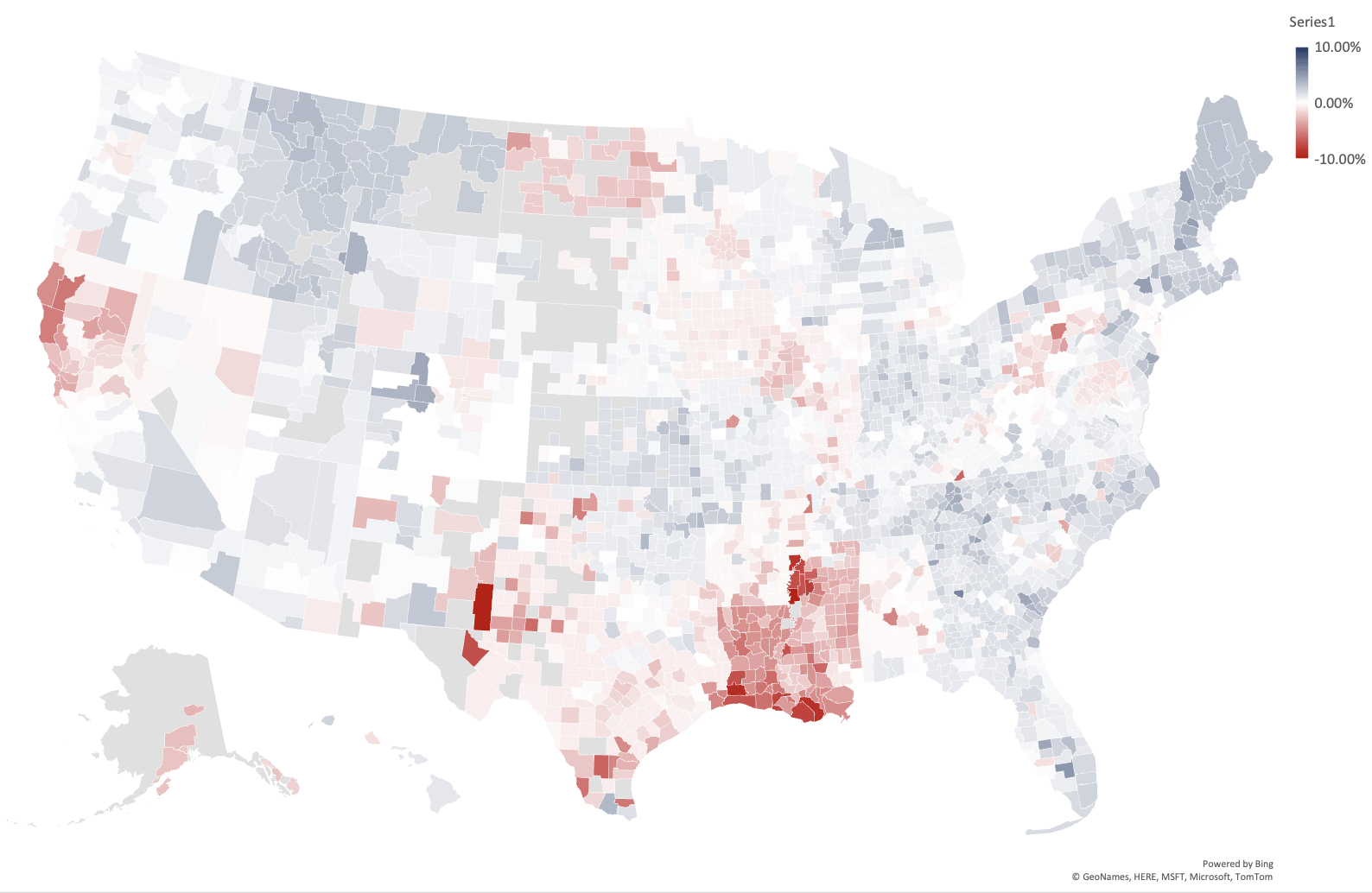

September 2024 National Real Estate Forecast: Updated Insights and Trends Explore our National Real Estate Forecast for 2024 for comprehensive insights into the U.S. luxury real estate market. Stay

Most firms don’t fail for lack of effort. They fail from operational noise—tools piled on tools, shifting priorities, and “urgent” initiatives that never institutionalize. In our advisory work across top-producing