Margins are tightening across the industry. Splits have crept up, portal leads cost more, and SG&A bloat hides in every line item. Most firms respond with volume goals or a

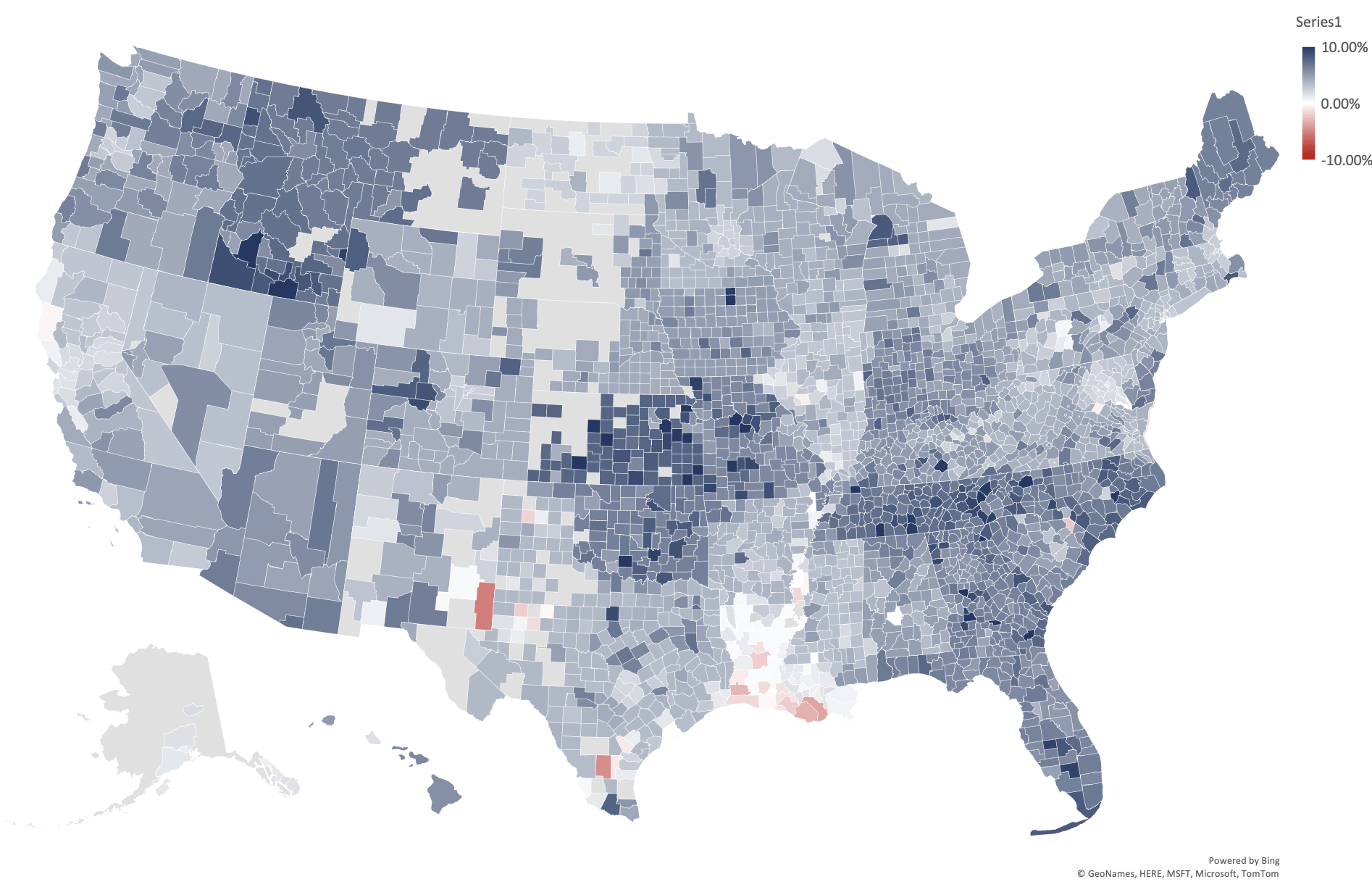

June 2023 National Real Estate Forecast We present the RE Luxe Leaders June 2023 National Real Estate Forecast down to the County. National Real Estate Forecast: Real Estate Insights: An

Top-producing firms don’t scale by charisma, recruiting volume, or tech stacking. They scale by installing an operating system—clear controls that standardize how revenue is generated, margin is protected, talent is

“`html 5 Ways Our Strength Assessment Revolutionizes Your Luxury Real Estate Business Unleash Your Top Five Strengths with Our AI-Powered Evaluation Personal Brand GPS: Values, Strengths, and Luxury Archetype Practical

Most firms talk growth; few talk discipline. The market has compressed margins, raised client expectations, and exposed operational debt. If your P&L feels volatile despite solid topline, the problem isn’t

Most top producers aren’t short on data—they’re drowning in it. Dashboards multiply, meetings drift, and leaders get updates that don’t change a single decision. This is where teams stall: activity

Thriving in Chaos: Insider Strategies for Growing Your Business in Turbulent Times Thriving in Chaos: Insider Strategies for Turbulent Times Description: In today’s unpredictable business landscape, the ability to