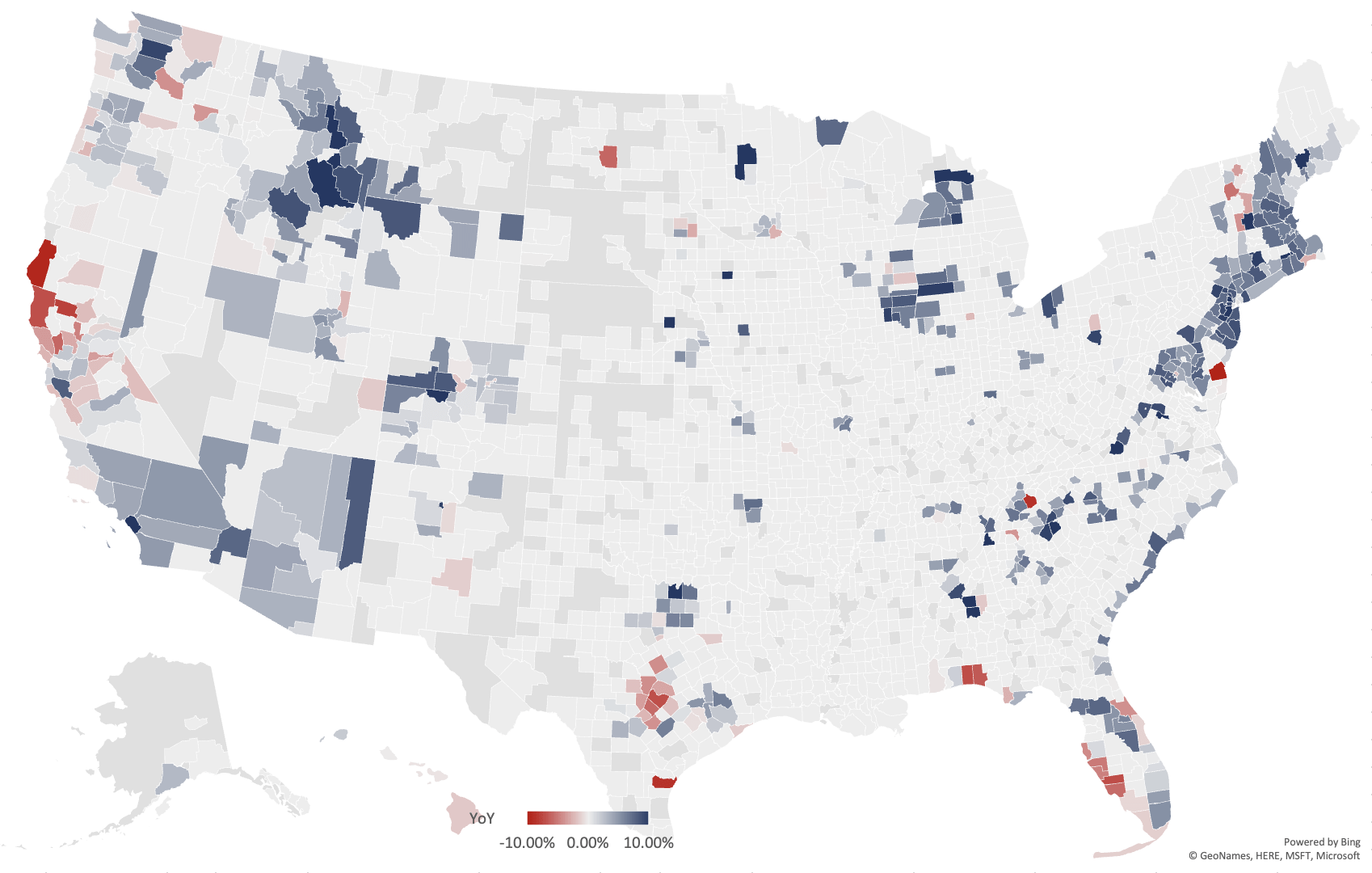

March 2024 Luxury Real Estate Report Explore the latest trends in the U.S. luxury real estate market with our newest report. Discover key insights into regional market dynamics, significant

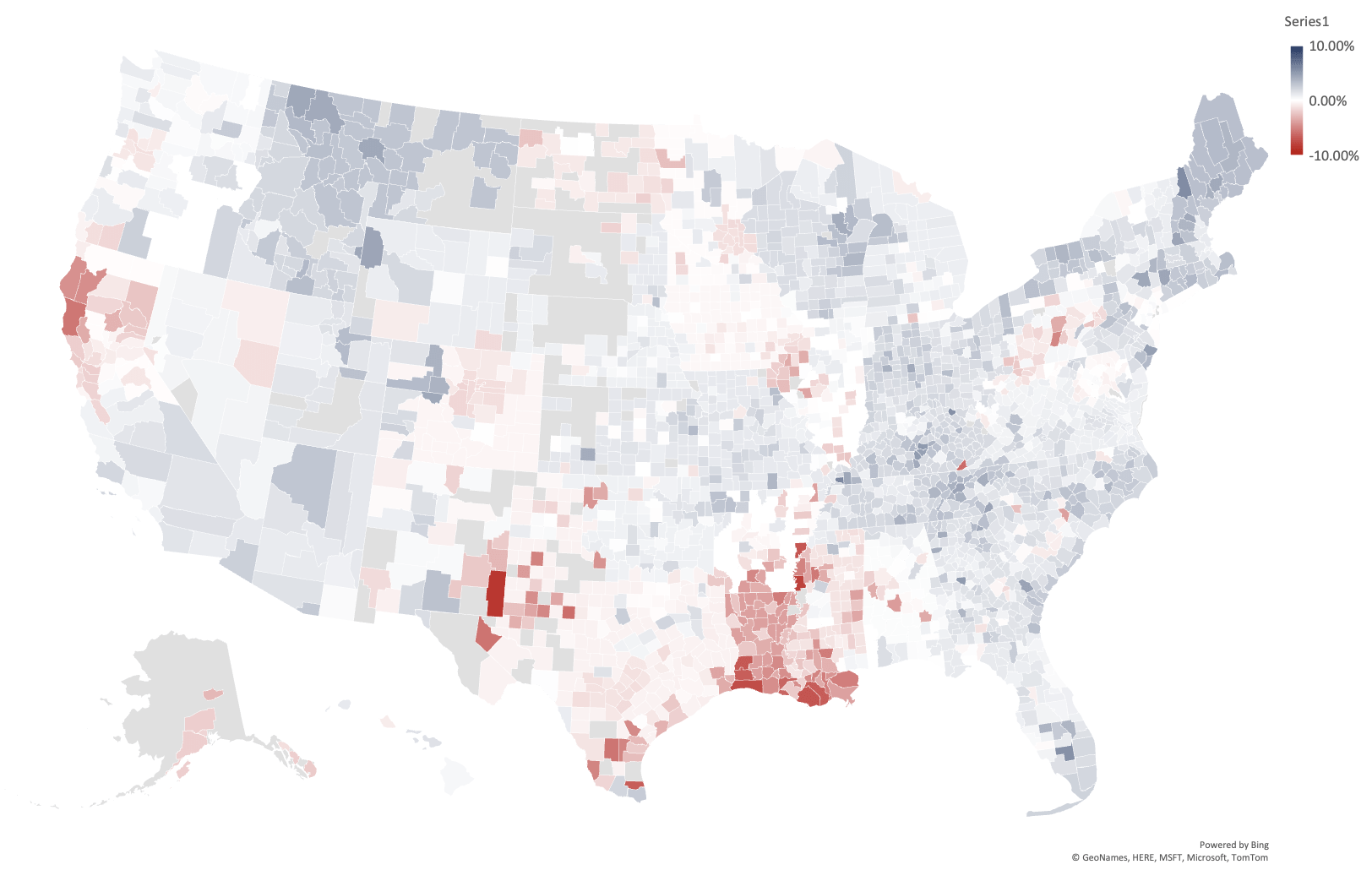

March 2025 National Real Estate Forecast: Insights and Trends for 2025 Explore our National Real Estate Forecast for 2025 for comprehensive insights into the U.S. luxury real estate market.

Most brokerage dashboards are crowded, slow, and inconclusive. Leaders stare at volume, sides, and GCI while profitability flatlines and top performers drift. The issue isn’t data scarcity—it’s signal quality. You

Growth without governance looks like momentum—until it doesn’t. Missed forecasts, unprofitable lead spend, and ad hoc hiring are not market problems; they are operating system problems. Elite firms run on

Top-producing firms don’t fail for lack of ambition; they fail from operational noise. Deals close, revenue lands, yet margins stall, service levels wobble, and leaders get pulled into firefighting. If

Most brokerages track numbers that explain the past—GCI, deals closed, headcount. Few instrument the handful of leading indicators that reliably predict margin, cash, and capacity. In a market defined by

Top producers are not winning on effort alone. The gap today is operating leverage—how precisely a firm turns strategy into consistent execution across people, pipeline, and P&L. If your revenue

Most firms try to scale before they standardize. Headcount rises, marketing spend expands, yet margin volatility worsens. If your growth relies on hero agents and reactive management, you don’t have

Most brokerages don’t lose profit on pricing or splits first. They lose it in the gaps between meetings—where decisions stall, forecasts drift, and accountability blurs. A disciplined brokerage operating cadence

Volatility isn’t a market problem—it’s an operating problem. Elite teams don’t wait for month-end reports to learn what went off the rails. They run a disciplined weekly scorecard tied to