Most brokerage leaders stare at dashboards packed with lagging data—closed volume, past GCI, last month’s headcount. By the time those numbers move, your margin already has. The fix isn’t more

If your organization still relies on heroics to hit the month, you don’t have an execution problem—you have a rhythm problem. Meetings drift, forecasts miss, and projects stall because there

High-growth brokerages stall for the same reason: they rely on individual excellence instead of institutional systems. When volume rises, decision latency, data ambiguity, and uneven execution compound into margin erosion.

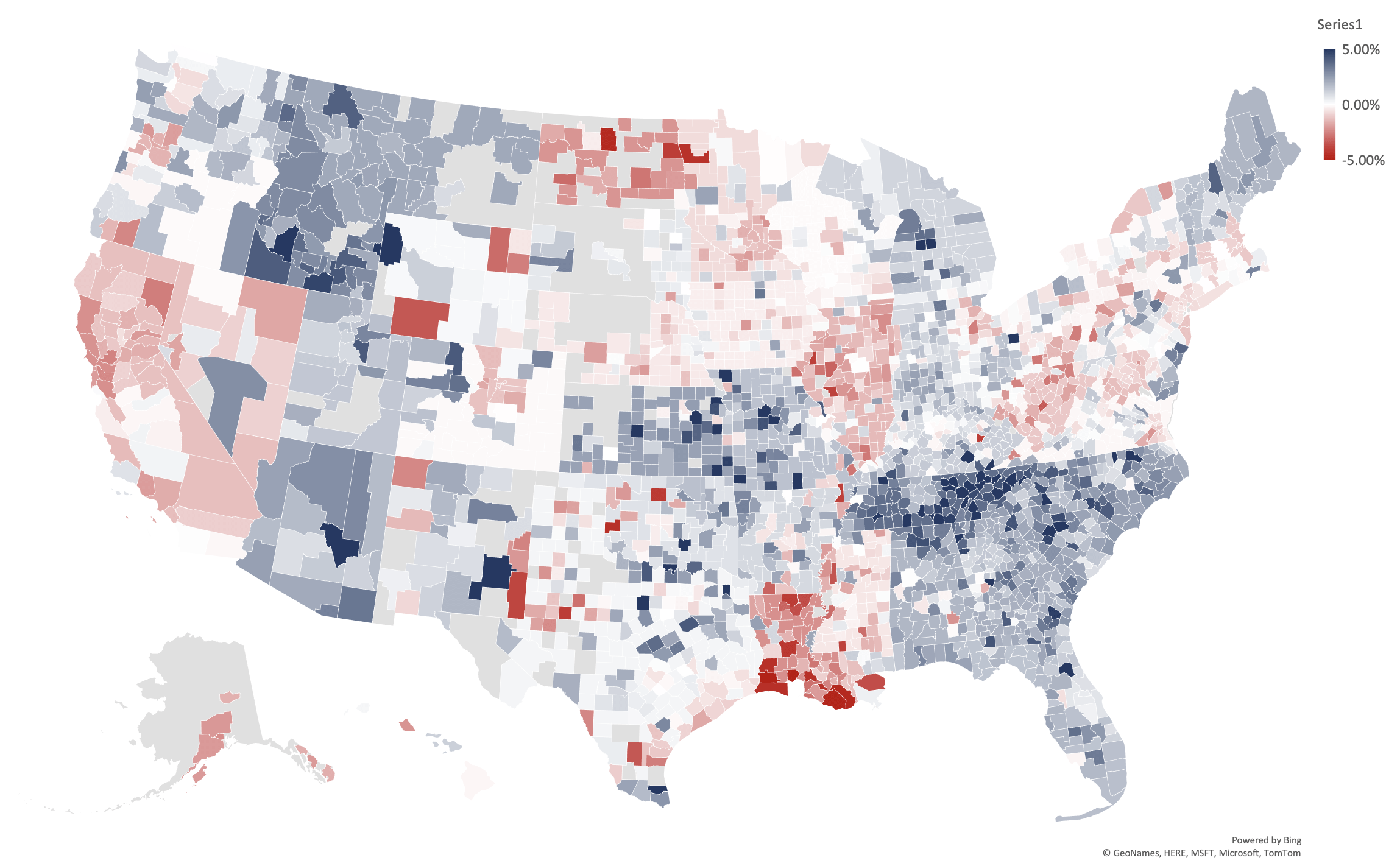

March 2023 National Real Estate Forecast We present the RE Luxe Leaders March 2023 National Real Estate Forecast down to the County. We are starting to see the turning of the tide on

Most brokerage leaders don’t suffer from a strategy problem. They suffer from an operating problem. Growth sits on the backs of a few rainmakers, reporting is late, and decisions get

Margin compression, split wars, tech sprawl, and regulatory volatility are not new. What is new: the speed at which operational drag is being penalized in the market. Teams and brokerages

Most brokerage leaders aren’t slowed by market conditions—they’re slowed by ad hoc operations. Meetings drift, recruiting is episodic, margins erode in the noise, and the P&L masks operational debt. The

Margins are being squeezed from all sides—split inflation, bloated tech stacks, softening unit velocity, and rising occupancy costs. Most brokerages don’t have a revenue problem; they have a model discipline