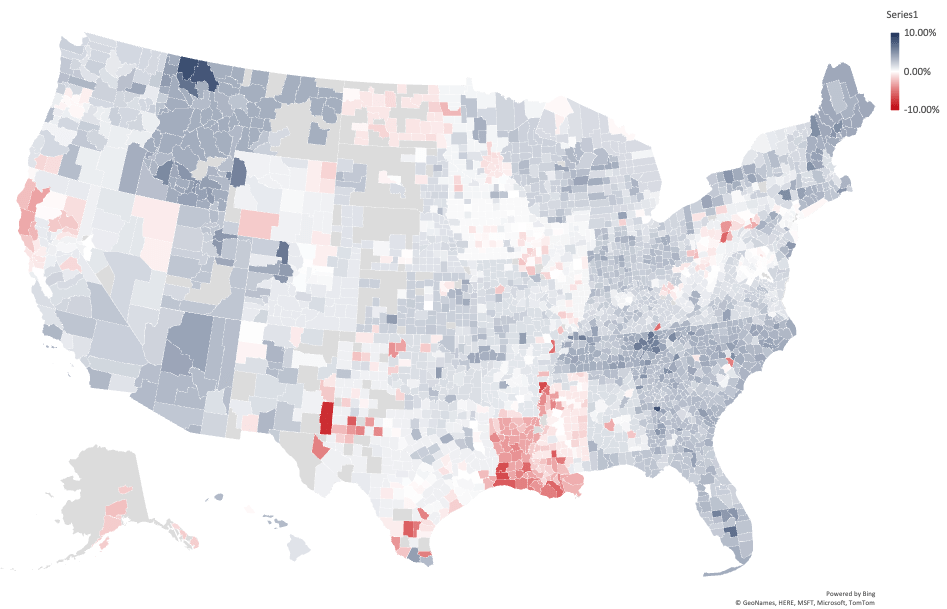

April 2024 National Real Estate Forecast: Key Market Trends Top ZIP Codes for Luxury Real Estate Investment in 2025: Discover High-Growth Opportunities and Key Market Trends Explore our National

High-performing firms aren’t winning on charisma or volume. They’re winning on operating discipline. If your net profit is volatile, recruiting is opportunistic, and decisions depend on whoever shouts loudest, the

Growth without systems is just accelerated entropy. As headcount and transaction volume climb, variability compounds—service levels slip, margin erodes, and the owner becomes the bottleneck. The firms that pull ahead

Navigating the NAR Settlement: Strategies for Thriving in Luxury Real Estate Dive deep into the implications of the NAR Settlement on luxury real estate with our expert-led webinar. Discover actionable

Primary keyword: brokerage operating system If your P&L is riding agent mood swings and market volume, you don’t have a business—you have exposure. A brokerage operating system turns variability into

Most brokerage leaders aren’t short on hustle. They’re short on structure. Production swings, recruiting churn, and tech sprawl are all symptoms of the same root problem: you’re running the business

Margins are getting clipped from every angle—commission compression, higher portal costs, tech bloat, and recruiting incentives that rarely pay back. The instinct is to hire your way out. Don’t. The

Margin compression is not a market cycle. It’s an operating reality. Rising splits, fragmented tech, and paid-lead inflation have quietly taxed the core economics of the brokerage model. If you

Top operators do not scale on personality or promotion. They scale on precision. If your brokerage operating system cannot surface the few metrics that actually govern margin, cash, and growth,