Margins have tightened while complexity has expanded. Split inflation, recruiting incentives, lead costs, and redundant tech have outpaced revenue growth in many firms. The pattern is predictable: more agents, more

7 Brokerage Financial Controls to Install Before Scaling Most brokerages don’t fail from lack of demand. They fail because cash, costs, and compliance don’t scale at the pace of sales.

Top performers don’t struggle with lead volume—they struggle with repeatable execution. Revenue grows; margin wobbles. Systems lag behind demand. At a certain threshold, personality and hustle stop working. What scales

Most brokerages are drowning in dashboards but starved for signal. Operators glance at GCI, units, and recruiting wins, then wonder why margin still erodes. The fix is not more data.

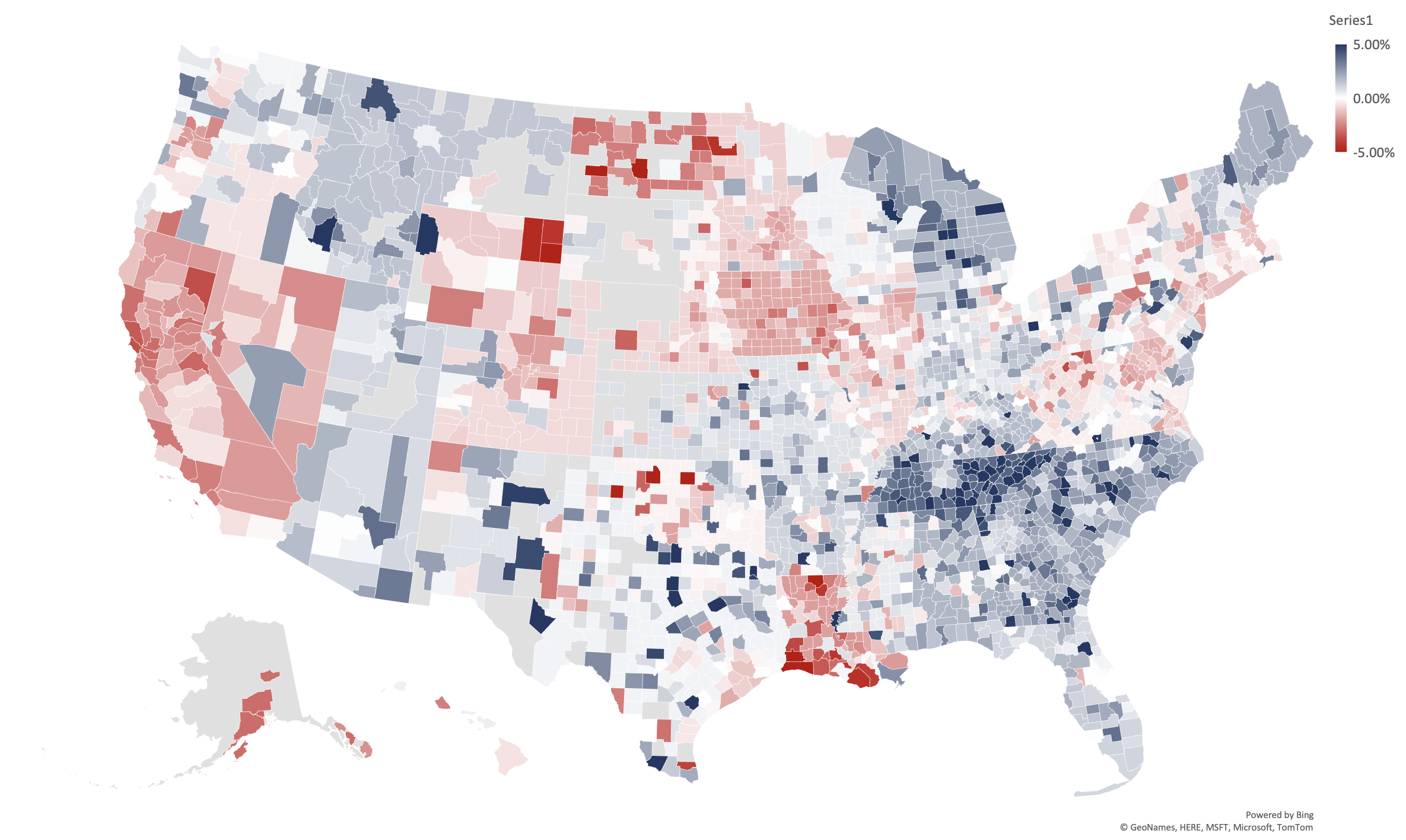

February 2023 National RE Forecast We present the RE Luxe Leaders February 2023 National RE Forecast down to the County. The Tennessee and the Carolinas are recent standouts. The forecast is developing

When volume tightens, the first thing that erodes isn’t revenue—it’s discipline. Recruiting incentives get sloppy. Lead budgets drift. Split exceptions multiply. Within two quarters, what looked like a manageable dip

High-output brokerages don’t stall because of market cycles—they stall because growth outpaces structure. When recruiting, marketing, and production expand faster than systems, leaders end up firefighting. Margin slippage follows. If

Most firms obsess over lagging reports—GCI, units closed, year-to-date profit—then act surprised when margins slip. Profit is built upstream. Operators who run on leading, controllable indicators see problems early, move

Top-line growth is not the problem. Margin is. Across elite teams and boutique brokerages, profit compression is coming from three places: compensation creep, overfunded lead sources with weak attribution, and