When top-line volume grows but profit stalls, the issue isn’t effort—it’s the absence of an integrated real estate operating system. Most teams and brokerages bolt tools onto talent and hope

Margins are compressing, platforms are bloated, and agent churn punishes undisciplined operators. If your firm is relying on charisma or hustle to drive growth, you are subsidizing avoidable risk. Elite

Most firms don’t fail for lack of leads. They fail because the business runs on slide decks, heroic managers, and an ungoverned tech stack. If you’re carrying top-line growth with

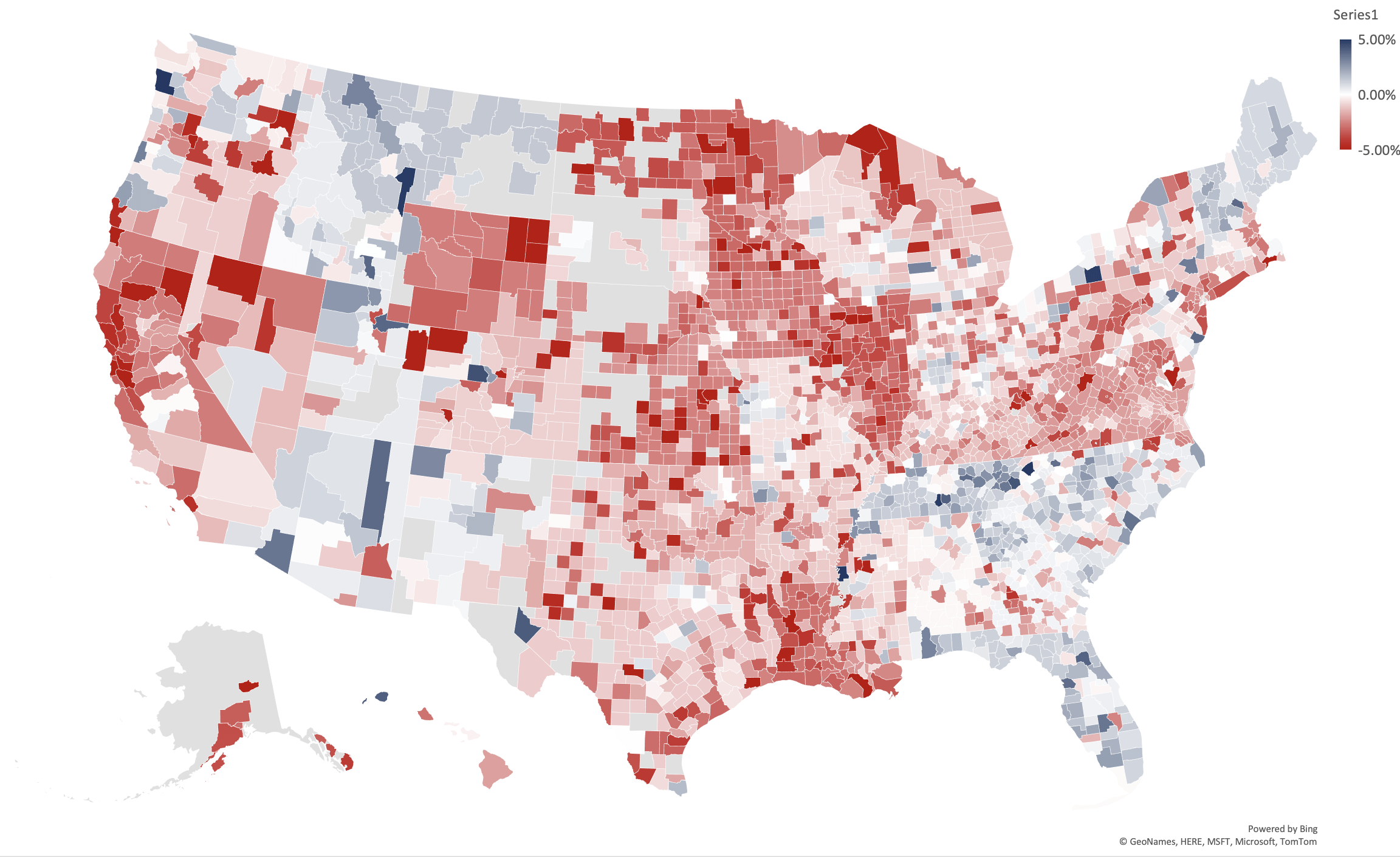

We present the RE Luxe Leaders Dec 2022 National RE Forecast Report down to the County. The mountain and coastal South East areas are leading the forecast going into 2023. The

Most brokerages run on institutional memory and individual heroics. That works until it doesn’t—usually at 40–70 agents, when margin, quality, and leadership attention start to fracture. If your brokerage operating

Most brokerage P&Ls are leaking in quiet, predictable places: splits that don’t align with contribution, marketing spend without payback discipline, and bloated vendor stacks built during the zero-rate era. When

Top producers don’t stall from lack of effort; they stall from lack of an operating model. If your P&L swings with seasonality, your pipeline depends on a few rainmakers, and

Top brokerages don’t win on charisma or momentum. They win on control. In this market—compression on commissions, rising CAC, and thin tolerance for inefficiency—anything less than a rigorous brokerage operating

Top-line growth is not the problem. Translation to profit is. Most teams carry hidden leakage—overfunded lead channels, underproductive calendars, and decision-making that runs on gut instead of data. If you

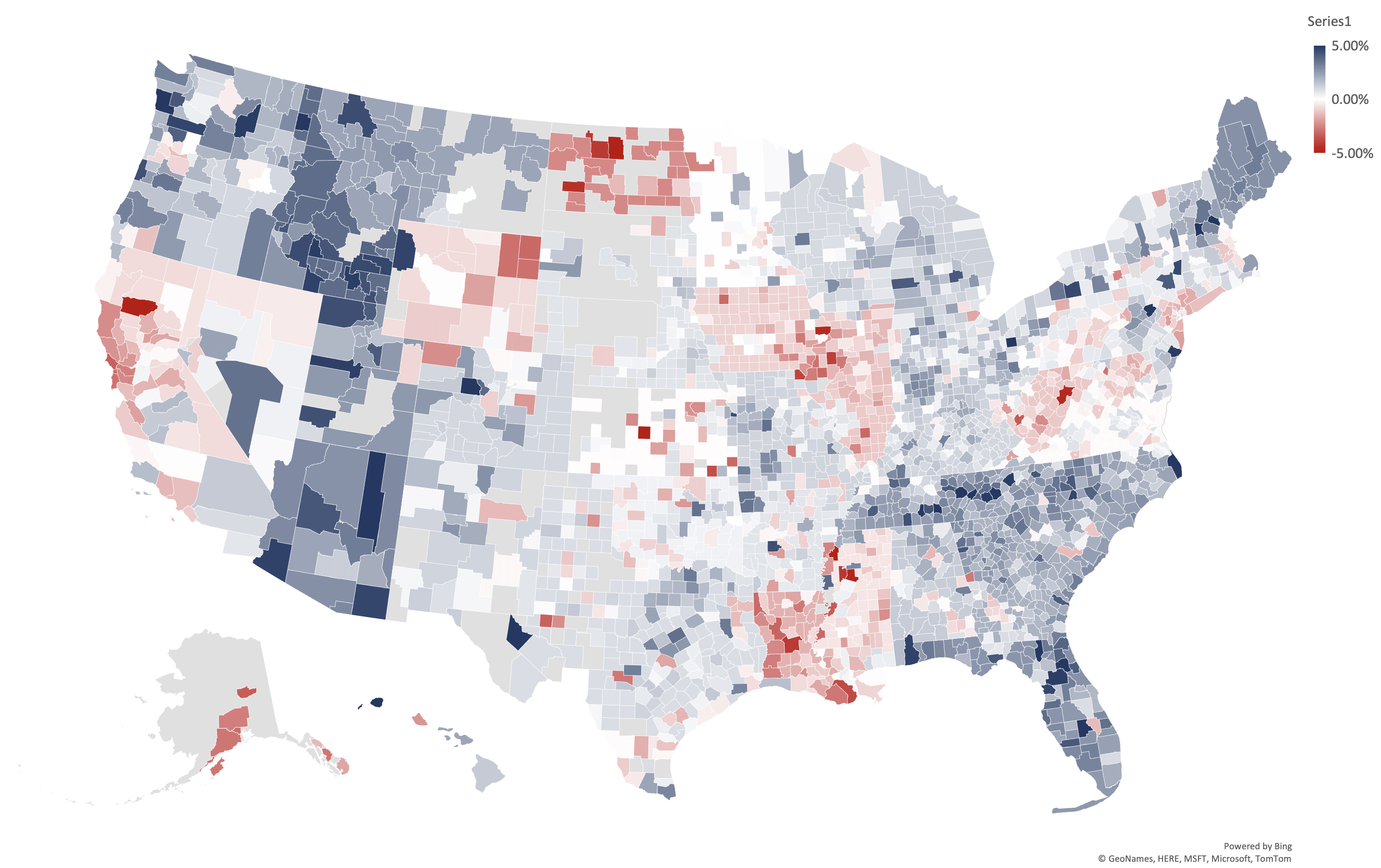

We present the RE Luxe Leaders Nov 2022 National RE Forecast Report down to the County. The mountain areas and south east are leading the forecast going into 2023. The forecast