Top teams don’t scale on talent and hustle alone. They scale on an operating system that turns strategy into weekly execution, protects margin, and delivers a uniform client experience regardless

Most firms can grow top line. Fewer grow margin. If your P&L tilts toward rising lead costs, bloated tech, and inconsistent agent output, you’re carrying complexity without control. The fix

Brokerage leaders don’t lack data—they lack signal. Dashboards filled with volume, GCI, and social metrics hide the operational truths that determine profit, durability, and scale. With margin pressure, rising churn,

Most teams track the easy numbers—GCI, units, lead count. Few track the metrics that actually predict profit. That gap is where margin is lost and scale stalls. If you’re operating

Scale exposes operational debt. When units, agents, and market coverage expand faster than systems, leaders spend more time firefighting than compounding. More leads or more recruits won’t fix it. You

Top producers aren’t struggling for leads—they’re struggling for coherence. As markets shift, capital tightens, and tech noise compounds, most firms add tools and headcount without adding operating discipline. The result:

Margins are tightening across the industry. Splits have crept up, portal leads cost more, and SG&A bloat hides in every line item. Most firms respond with volume goals or a

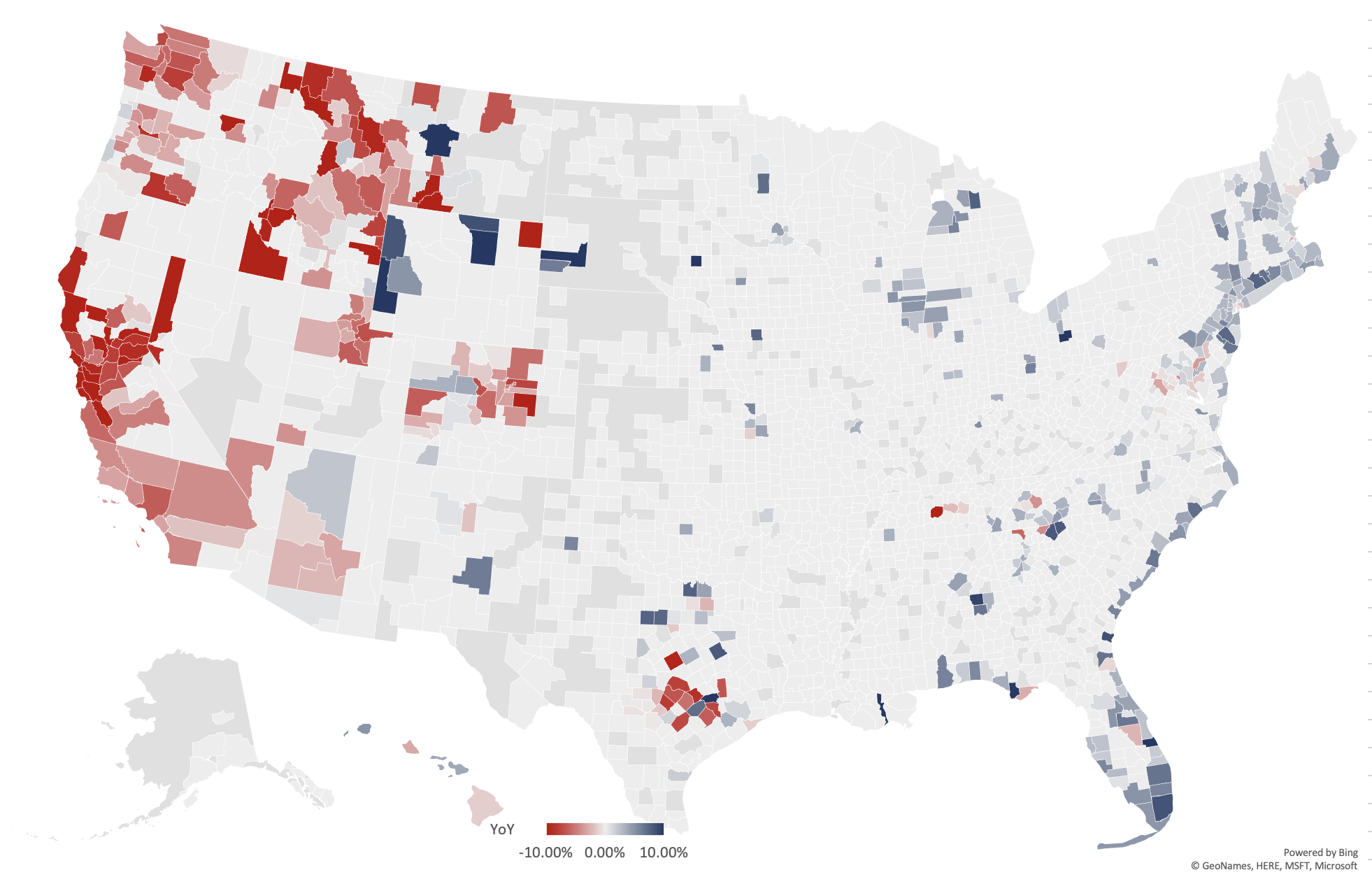

Luxury Real Estate Outlook: June 2023 – A Guide to Success in the US Market At RE Luxe Leaders, we’re passionate about digging into the data to spotlight trends